The Canada Revenue Agency (CRA) has announced the 2024 Tax Free Savings Account (TFSA) contribution limit is $7,000. This is up from the 2023 contribution limit of $6,500.

Want to learn more about this investment option? Read on to learn the ins and outs of TFSAs – from finding your limit to accurately tracking your contributions.

What is a TFSA?

Since 2009 TFSAs have helped Canadians earn tax-free income on investments.

Set up as a registered investment or savings account, TFSAs can hold a variety of investments, including cash savings, mutual funds, securities listed on a designated stock exchange, guaranteed investment certificates (GICs), and bonds.

As the name indicates, all income earned in a TFSA remains tax free and allows Canadians to build up tax-free savings over the course of their lifetime.

1. FHSA: First Home Savings Account

The FHSA is a game-changer for first-time homebuyers. It allows you to save for your dream home while benefiting from tax advantages. Contributions are tax-deductible, and withdrawals for qualifying home purchases are tax-free. If buying a home is in your future, this account can give you a head start while reducing your taxable income.

Key Benefit: Tax-deductible contributions and tax-free growth.

2. TFSA: Tax-Free Savings Account

A TFSA is perfect for anyone looking to grow their investments without worrying about taxes. Whether you’re saving for short-term goals or building long-term wealth, the income and growth in a TFSA are completely tax-free. Plus, you won’t face penalties when you withdraw your funds.

Key Benefit: Tax-free growth and withdrawals, making it a flexible savings tool.

3. RRSP: Registered Retirement Savings Plan

The RRSP is a staple for Canadians looking to secure their financial future while enjoying immediate tax benefits. Contributions reduce your taxable income for the current year, and the funds grow tax-deferred until retirement. Planning for your future has never been more rewarding.

Key Benefit: Immediate tax deductions and tax-deferred growth.

What is the TFSA limit for 2024?

The annual TFSA limit for 2024 is $7,000, which is an increase from $6,500 in 2023.

That means you can contribute $7,000 to your TFSA this year. Since you can carry forward any unused contribution room, you may be able to contribute even more.

It also means that starting on January 1, 2024, eligible Canadians will now have a cumulative lifetime TFSA contribution limit of $95,000 (see “What is the lifetime contribution limit for TFSA?” below for examples and charts).

What is my TFSA contribution room?

While you’re limited with how much you can contribute each year, the good news is that your TFSA contribution room grows every year (minus any withdrawals).

Your contribution room is made of:

- Your yearly TFSA dollar limit

- Plus any unused contribution room since 2009

- Plus any withdrawals made in the previous year*

*Any withdrawals from your TFSA will be added back to your contribution room at the beginning of the next year.

So, if you withdrew money from your TFSA in 2023, you could reclaim that contribution room in 2024.

You can open as many TFSAs as you want, but the amount of money you can contribute is limited, no matter how many accounts you have.

What is the lifetime contribution limit for the TFSA?

If you’ve never opened a TFSA before, you can deposit a hefty chunk of change to the account – $95,000 total (as long as you were 18 or older in 2009).

Listed below are the cumulative and annual limits since the program began, as well as how withdrawals from TFSAs are accounted for:

- If you were 18 years old in 2009 and have not contributed to a TFSA at all, using the table below, your maximum contribution in 2024 would be $95,000

- If you turned 18 any time after 2009, your lifetime TFSA contribution limit begins the year you turned 18

Where can I find my TFSA contribution room?

You can confirm your TFSA contribution room through logging into CRA MyAccount for Individuals or by calling the Tax Information Phone Service (TIPS) at 1-800-267-6999. If you have an authorized representative, they can also get these details for you.

The CRA can provide you with a TFSA Room Statement to confirm your contribution limit and a TFSA Transaction Summary to confirm the contributions and withdrawals the CRA has received from your TFSA issuer(s).

Tip: It’s a great idea to track your own transaction records of withdrawals and contributions. The CRA determines your available TFSA contribution room based on information provided annually by TFSA issuers, so it’s in your own best interest to ensure that your records align with that of the CRA.

How do I qualify for a TFSA?

Any resident of Canada who is 18 years old with a valid Social Insurance Number (SIN) accumulates TFSA contribution room each year (since 2009), even if they do not file a tax return or open a TFSA.

Yearly contribution limits are set by the federal government. However, even if you do not max out your TFSA in one year, the unused contribution room will carry forward into the following year as part of your lifetime contribution limit.

Notable exceptions

As stated above, TFSAs are available to any Canadian resident 18 years of age or older with a valid SIN.

The only exception to this rule is if you live in a province or territory where you cannot enter an agreement or contract – which would be necessary to open a TFSA – until the age of 19. In this case, your contribution limit for the year you are 18 rolls over to the following year.

Non-residents who are over 18 years old with a valid SIN are also eligible to open an account. However, if you contribute while you are a non-resident, you will be taxed 1% for every month you keep your contribution in the account. For more information about non-residents, please see the CRA website.

What is the penalty for going over my TFSA limit?

If you go over your TFSA contribution limit, this excess amount will be subject to a 1% per month penalty tax for as long as that excess amount remains in your account. For example, if you over contribute $3,000 in a year, you will pay $30 per month, every month you remain in excess – that’s $360 in penalties in one year alone.

This is why it’s so important to review your TFSA contributions, annual withdrawals, and limits before you add additional funds in the year.

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

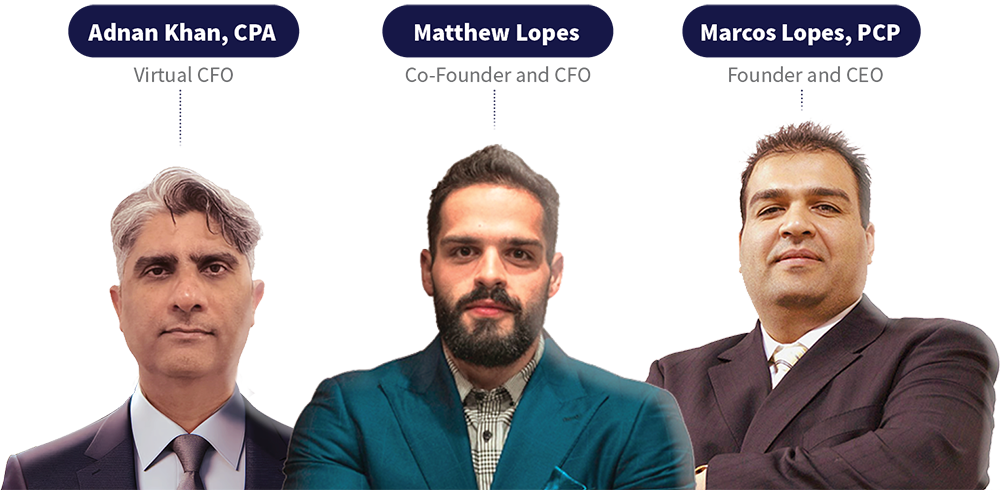

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.

Our Services

Bookkeeping

Personal & Corporate Tax

Virtual CFO

Business Formation

Financing Solution

Payroll

Software Integration

Consulting

![]()

M7 Figures was established as a consultancy with the goal of creating companies worth seven figures.