The importance of a Personal Tax Accountant

Navigating the complexities of personal taxes can be a challenging task for Canadian residents. In this blog, we’ll explore why hiring a personal tax accountant is a wise decision and how it can benefit both your financial well-being and peace of mind.

While it’s beneficial to attract customers through enticing financial incentives, it’s crucial to emphasize the value our accounting services bring to their businesses. Encouraging clients to choose our company goes beyond monetary advantages, emphasizing the unparalleled expertise, personalized attention, and strategic financial insights that set us apart in the realm of accounting.

Expert Tax Knowledge

Expert tax knowledge is invaluable when navigating complex tax laws and regulations. Tax professionals, such as CPAs or tax attorneys, can help you optimize deductions, credits, and tax strategies, potentially saving your business money and ensuring full compliance with tax authorities. Their expertise is particularly essential in situations involving tax audits or complex financial transactions.

Time Efficiency: Accounting Services

Hiring a personal tax accountant provides access to a professional with in-depth knowledge of the ever-changing tax laws and regulations. They can identify opportunities for tax optimization, ensuring you take advantage of deductions, credits, and exemptions to minimize your tax liability while remaining fully compliant with tax laws.

Tax Accountant’s Audit Support

When you have a personal tax accountant, you gain the advantage of having a knowledgeable advocate in case of tax audits or inquiries from tax authorities. Your accountant can guide you through the audit process, help prepare documentation, and represent your interests during interactions with tax authorities. This level of support can alleviate the stress and uncertainty that often accompanies tax audits, ensuring you have a trusted professional to navigate the complexities of the situation on your behalf.

Financial Planning

A tax accountant can significantly aid in financial planning by providing expert guidance on optimizing your tax strategies, identifying tax-efficient investment opportunities, and ensuring you take full advantage of available deductions and credits. They can also assist in structuring retirement and estate plans to minimize tax implications, offer insights into budgeting, and provide year-round financial advice, ultimately helping you achieve your financial goals while staying compliant with tax regulations.

Stress Reduction

Engaging a personal tax accountant can save you significant time and reduce stress during tax season. They handle the complex tax preparation process, freeing you from the hassle of navigating forms and calculations. This allows you to focus on your other financial and personal priorities while having confidence that your taxes are being handled accurately and efficiently.

Hiring a personal tax accountant is a strategic investment in your financial future. Their expertise, time-saving benefits, error prevention, financial planning guidance, and stress reduction can significantly enhance your financial well-being.

If you’re looking for expert assistance in managing your personal taxes and achieving financial peace of mind, then contact M7 Group Our personal tax accountants are here to help you navigate the complex world of taxation.

For more information on how M7 Group can assist you, and other tax-related matters, contact us today.

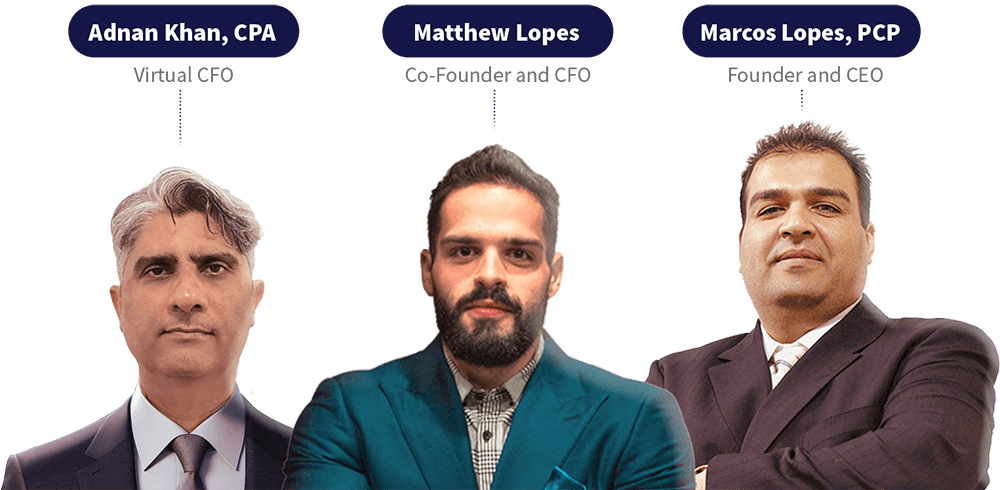

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.