“I’ll be more organized next year.” You said to yourself this time last year.

We’ve heard it time and again—people don’t just dislike paying taxes, they also dread gathering all the paperwork to prepare them. For employees, the process is usually straightforward. But for entrepreneurs and small business owners, filing taxes can get a bit more complex. If you fall into the latter category, this article is for you! Read more: ‘What are the benefits of accounting services for my business?’

Are You Organized or Disorganized?

Organized: Your expense spreadsheets or accounting software are always up to date at the end of every month.

Disorganized: Your receipts are crumpled in a box (if you even saved them!), making tax time a scramble.

Which one are you?

If you’re in the “organized” group, congratulations! You’re likely running a well-structured, successful business. But if you’re in the second group—the busy, creative entrepreneur who would rather be closing deals or networking instead of worrying about bookkeeping—you’re not alone.

Don’t worry, disorganization doesn’t mean failure. This year, though, we challenge you to approach things differently with your receipts, books, and taxes.

How to Take Control of Your Business Finances

Understand Your Business Finances

As a business leader, it’s crucial to have a solid understanding of your financials. Take responsibility for every aspect of your business, particularly its financial health.Hire the Right Help

Consider bringing on a professional who excels at working with numbers. Whether you need assistance with setting up your accounting systems or ongoing support, outsourcing can free you to concentrate on your core strengths.Review Financial Reports Regularly

Make it a monthly habit to review your financial reports. Regular check-ins help you stay on top of your business’s cash flow and empower you to make informed decisions.Change Your Mindset About Money

Reflect on your beliefs surrounding money. Are these beliefs propelling you toward success, or are they holding you back? A shift in mindset can significantly impact your financial management.Create a Comprehensive Plan

Develop a Financial Plan, a Business Plan, and even a Life Plan. These documents will guide you in making long-term decisions and preparing for the future.Make Finances Fun

Transform your financial reviews into a positive experience! For instance, when paying expenses, round up to the nearest dollar and express gratitude for what that expense enabled you to achieve in your business.Know When to Seek Help

The most successful business owners understand their strengths and weaknesses. If handling finances isn’t your forte, hiring external help or implementing robust systems will allow you to focus on the aspects of your business you’re truly passionate about.

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

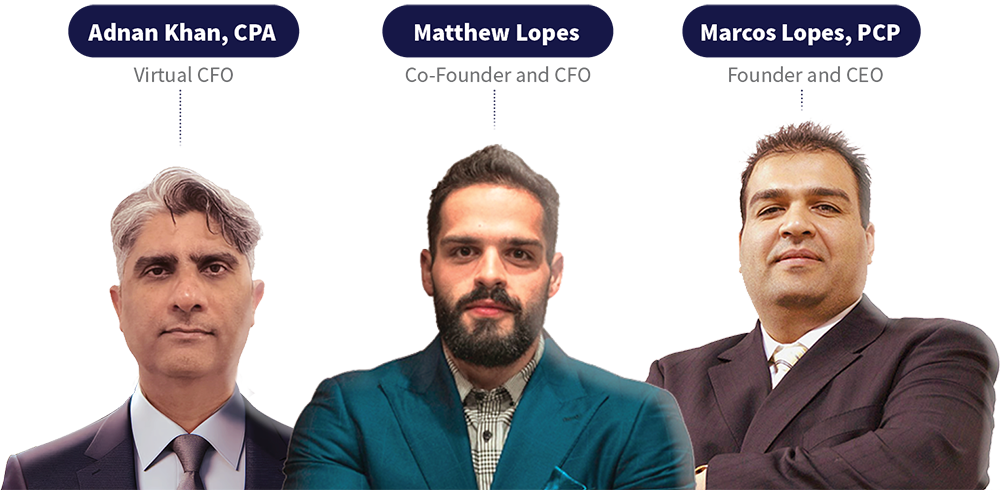

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, CPC. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.

Our Services

Bookkeeping

Personal & Corporate Tax

Virtual CFO

Business Formation

Financing Solution

Payroll

Software Integration

Consulting

![]()

M7 Figures was established as a consultancy with the goal of creating companies worth seven figures.