Get ready for corporate tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing. Click to learn more!

As Tax Season 2025 approaches, preparation is key to maximizing your refund and minimizing stress. Whether you’re a freelancer, self-employed individual, or filing as an employee, here are essential tips to get ahead for Tax Season 2025 in Canada

1. Organize Your Financial Documents

Getting your financial records in order early is crucial. Here’s what to collect:

- Income Statements: Gather all T4s, T5s, and any other income documents. Ensure you have a complete record of all income sources.

- Expense Receipts: Collect receipts for business expenses, medical expenses, and charitable donations. Keeping these organized will make it easier when it’s time to file.

- Investment Records: If you have investment income, compile documentation related to stocks, bonds, and other financial instruments to report capital gains or losses accurately.

Pro Tip: Utilize accounting software to keep track of your financial documents throughout the year, making tax time less overwhelming.

2. Maximize Deductions and Credits

Understanding which deductions and credits you qualify for is essential in Canada. Some key items to consider include:

- Deductions: Explore deductions such as the Home Office Deduction, Childcare Expenses, and contributions to your RRSP (Registered Retirement Savings Plan). Each of these can significantly reduce your taxable income.

- Credits: Look for available tax credits, such as the GST/HST credit, which can lower your tax bill.

Pro Tip: Many Canadians overlook medical expenses, which can be deducted. Ensure you have all relevant receipts gathered in one place.

3. Stay Updated on Tax Law Changes

Tax laws can shift, so it’s important to stay informed about any updates from the Canada Revenue Agency (CRA) for 2025. Changes may affect your deductions, credits, and overall tax liability. Key areas to monitor include:

New tax credits or benefits, such as the Climate Action Incentive

Adjustments to tax brackets or rates

Changes to rules regarding RRSP contributions or other tax-deferred accounts

4. Make Estimated Tax Payments

If you’re self-employed, remember to set aside money for estimated quarterly tax payments to avoid penalties at year-end. Here’s what you need to know:

The CRA requires that self-employed individuals make these payments to avoid interest charges or penalties.

Plan your finances to ensure you have sufficient funds available when these payments are due.

5. Know Your Deadlines

Understanding your filing deadlines can prevent late fees and penalties. Here are the key dates for Tax Season 2025:

- Filing Deadline: For most individuals, the tax deadline is April 30, 2025. However, self-employed individuals have until June 15, 2025, to file their returns.

Pro Tip: Even if you file for an extension, any taxes owed must be paid by the original deadline to avoid penalties.

6. Consult a Tax Professional

Tax preparation can be complex, especially if you’ve experienced significant life changes, such as starting a business or buying a home. A tax advisor can help you navigate the intricacies of the tax system, ensuring you’re maximizing deductions and credits.

- Expert Support: A tax professional can provide guidance tailored to your specific situation, helping you understand benefits like the GST/HST credit and managing capital gains from investments.

Ready to conquer Tax Season 2025?

Reach out to M7 Tax today for expert guidance and personalized strategies designed specifically for you! Don’t let tax season overwhelm you—let us help you navigate it with confidence.

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

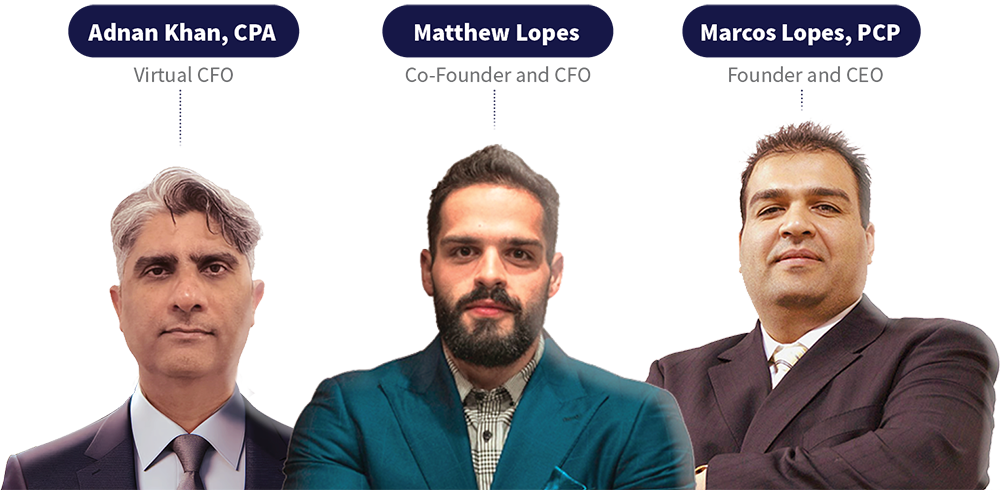

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.

Our Services

Bookkeeping

Personal & Corporate Tax

Virtual CFO

Business Formation

Financing Solution

Payroll

Software Integration

Consulting

![]()

M7 Figures was established as a consultancy with the goal of creating companies worth seven figures.