With the tax deadline behind you, it’s the ideal time to shift your focus to next year’s tax season. Want to ensure you maximize your refund for 2025? Waiting until tax season could cost you! By taking proactive measures now, you can set yourself up for financial success and get a head start on tax savings. Here’s how to make smart adjustments to enhance your refund next year.

Optimize Your Tax Deductions

One of the most effective ways to secure a larger refund is by adjusting your personal tax withholding now. Many Canadians are caught off guard during tax season with unexpected bills due to insufficient tax withheld throughout the year. Review your TD1 form and consider increasing your withholding. This proactive step ensures that more taxes are paid upfront, reducing the likelihood of a hefty tax bill in the spring.

A minor adjustment today can lead to a substantial refund next year. Instead of stressing over unexpected payments, you can anticipate a refund or, at the very least, break even.

Stay Organized with Yearly Deductions

To truly maximize your refund, it’s crucial to keep track of your deductions year-round. Don’t wait until tax time to scramble for receipts! Start now by organizing your documents. Create a dedicated file labeled “Current Tax Info” and place any receipts or records of deductible expenses in it.

Whether it’s business expenses, charitable contributions, or home office deductions, having everything organized will save you time and ensure you claim every deduction you deserve. This straightforward system helps you avoid leaving money on the table come tax season.

Leverage Tax-Advantaged Savings Accounts

Want to enhance your refund while saving for your future? Consider contributing to tax-advantaged accounts like an RRSP (Registered Retirement Savings Plan). Contributions to an RRSP not only help build your retirement savings but also reduce your taxable income.

For 2024, you can contribute up to 18% of your earned income, up to a maximum of $30,780, depending on your previous year’s earnings. If you’re over 71, you can set up a RRIF (Registered Retirement Income Fund) to keep your retirement savings growing tax-deferred.Want to enhance your refund while saving for your future? Consider contributing to tax-advantaged accounts like an RRSP (Registered Retirement Savings Plan), HSA (Health Savings Account), or TFSA (Tax-Free Savings Account).

👉 RRSP (Registered Retirement Savings Plan)

Contributions to an RRSP not only help build your retirement savings but also reduce your taxable income. For 2024, you can contribute up to 18% of your earned income, up to a maximum of $30,780, depending on your previous year’s earnings. If you’re over 71, you can set up a RRIF (Registered Retirement Income Fund) to keep your retirement savings growing tax-deferred.

👉 HSA (Health Savings Account)

An HSA is a great way to save for medical expenses while enjoying tax benefits. Contributions to an HSA are tax-deductible, reducing your taxable income for the year. Additionally, any earnings in the account grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSAs a valuable tool for managing healthcare costs while saving on taxes.

👉 TFSA (Tax-Free Savings Account)

A TFSA allows you to save and invest your money tax-free. Unlike RRSPs, contributions to a TFSA are not tax-deductible, but any earnings and withdrawals are completely tax-free. For 2024, the contribution limit is $6,500, and unused contribution room carries forward, giving you flexibility in your savings strategy. TFSAs are ideal for short-term and long-term savings goals, allowing you to grow your money without worrying about tax implications.

By strategically contributing to these tax-advantaged accounts, you not only enhance your tax refund but also set yourself up for a more secure financial future. Make the most of your contributions and take control of your savings strategy today!

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

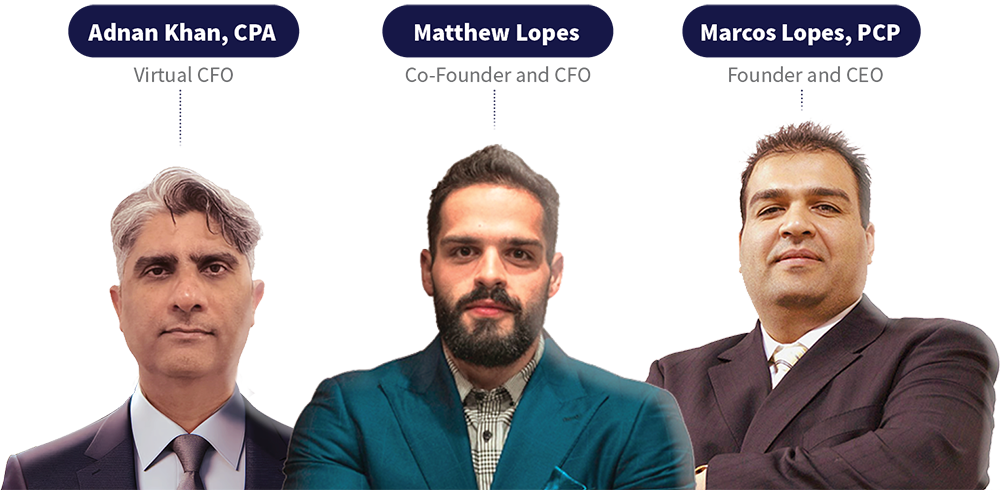

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive personal and corporate tax accounting, and financial advisory services and cross-border tax accounting.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.

Our Services

Bookkeeping

Personal & Corporate Tax

Virtual CFO

Business Formation

Financing Solution

Payroll

Software Integration

Consulting

![]()

M7 Figures was established as a consultancy with the goal of creating companies worth seven figures.