Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

Avoid Tax Season Delays by Keeping Your CRA Account Up To Date

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

A Tax Refund Is Not a Bonus. It Is a Strategy.

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

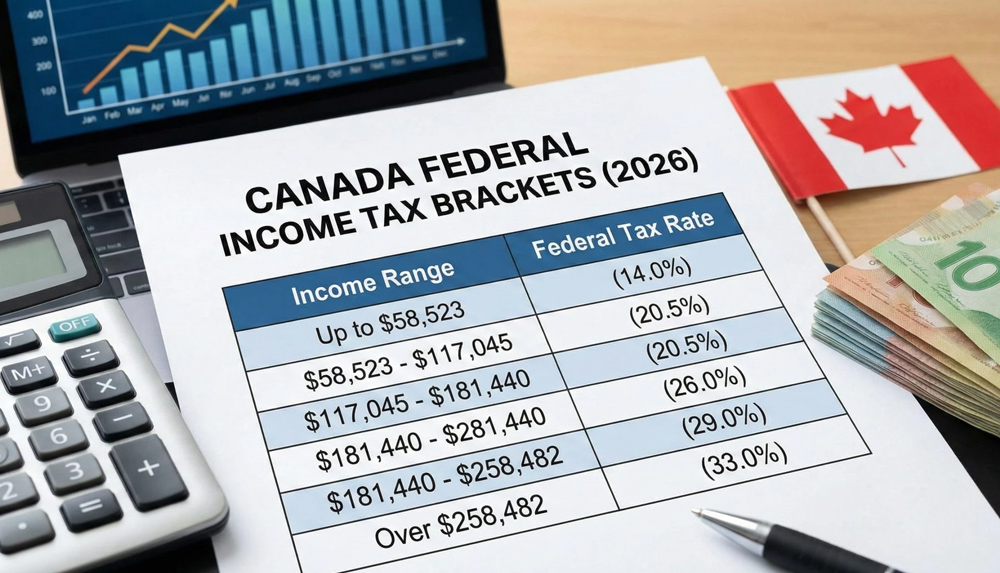

2026 Canadian Tax Brackets: How the New Rates Help You

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

How to Work with U.S. Clients and Pay $0 in U.S. Taxes (Legally)

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

The Owner-Operator’s First Truck Checklist

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

Behind the Books: Your Audit-Proofing Checklist

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

Why You’re Getting Audited… And How to Avoid It

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

Extra Cash Alert: Your GST Credit Is Getting a Boost in July

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

Mississauga Tax Deadlines Every Small Business Owner Needs to Know

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.