Just Registered Your Business? The Next Steps You Can’t Miss

Congratulations on registering your business! 🚀 Whether you’re launching a startup or expanding your passion into a full-fledged enterprise, the journey from registration to success involves a few crucial steps. The paperwork may be behind you, but the groundwork for a thriving business has just begun. Let’s walk through the next essential actions to ensure your business is set up for long-term success.

1. Obtain Your Business Number

The first thing you need to do after registering your business in Canada is to obtain a Business Number (BN). The BN is a unique 9-digit identifier that the Canada Revenue Agency (CRA) assigns to your business. This number is essential for dealing with the CRA on matters like tax filings, payroll, and other government-related interactions. It’s your key to unlocking a variety of federal, provincial, and municipal services. Read more!

Without a BN, you can’t register for essential programs like GST/HST, payroll, or corporate income tax. Make this a priority to ensure you’re legally compliant from the get-go.

2. Register for HST/GST

Depending on where you operate, you may need to register for the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST). This is crucial if your business’s revenue is expected to exceed $30,000 annually. Even if you’re starting small, it’s wise to register early to avoid penalties and ensure compliance with Canadian tax laws.

Registering for GST/HST allows you to charge tax on your sales and claim input tax credits on your business purchases. This can be a significant benefit as your business grows. Failure to register on time can result in missed opportunities and potential fines, so it’s better to be proactive.

3. Open a Business Bank Account

A dedicated business bank account is more than just a convenience; it’s a necessity. Separating your business finances from your personal accounts helps maintain clear records, simplifies bookkeeping, and provides a professional image to clients and suppliers.

When it comes to corporate tax season, having a separate account will make it easier to track income, claim deductions, and avoid potential CRA audits. It also simplifies the process of getting business loans or credit down the line, as lenders will want to see clear financial records.

4. Secure permits and insurance

ensure your business is legally protected by obtaining the necessary permits and insurance. depending on your industry, you’ll need specific licenses to operate and insurance coverage to safeguard against potential risks. this step is crucial to avoid fines and protect your assets.

5. Set up an accounting system

Organize your finances from the start by setting up an efficient accounting system. tracking receipts and expenses is vital for accurate bookkeeping, tax filing, and maintaining a clear financial overview. whether using software or hiring a professional, keeping your records in order is key to business success.

6. Prepare for annual return filing

Annual return filing is a mandatory requirement for businesses. It involves submitting key financial statements and other necessary documents to regulatory authorities. Preparing early ensures you meet deadlines and avoid penalties, keeping your business in good standing with a professional accounting firm.

Keep the Momentum Going

Starting a business is an exciting milestone, but the real challenge lies in the execution. By following these steps—obtaining your BN, registering for HST/GST, opening a business bank account, organizing your finances, and consulting a financial advisor—you’re laying a solid foundation for success.

Remember, each of these steps is interconnected, and skipping one could lead to complications down the line. Take the time to set up your business correctly, and you’ll be better prepared to handle whatever challenges come your way. The momentum is on your side—keep pushing forward!

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

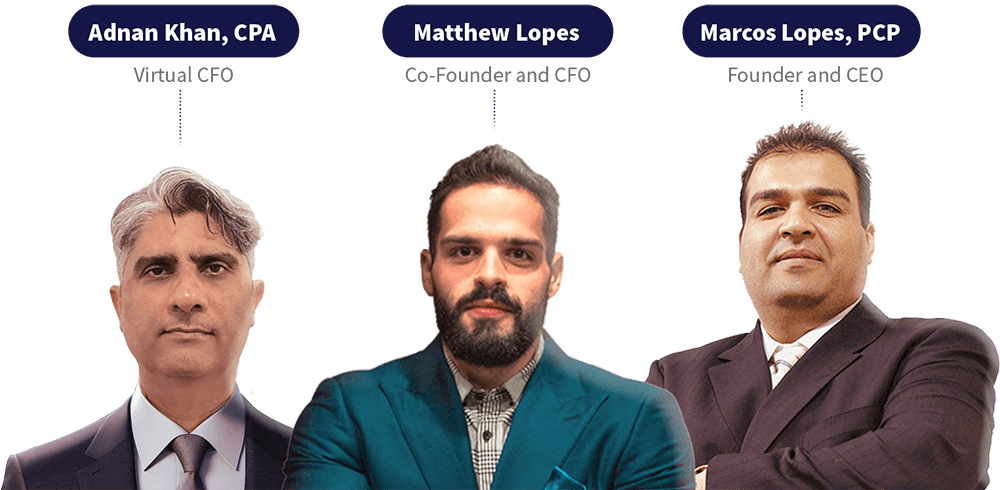

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.