You’re Being Audited… Now What?

“You’re being audited…” is the last thing anyone wants to hear. So, how can you make sure you’re steering clear of a CRA audit?

The Critical Role of Bookkeeping in Business

How M7 Group Can Help Your Business

Use Software to Keep Your Business Bookkeeping Organized

In the fast-paced world of business, relying on manual bookkeeping methods is not just inefficient; it’s also risky. The CRA expects businesses to maintain accurate and up-to-date records, and this is where bookkeeping software comes in. By automating many tasks that once required hours of manual work, these software solutions help you stay organized and compliant.

We have represented numerous clients, and thanks to their well-organized books, they received significant refunds. In one case, a client mistakenly recorded some expenses under their personal name instead of the business’s name. After diligently advocating for our client, we succeeded in ensuring these expenses were not removed from their return. The CRA acknowledged our position and sent a letter highlighting that the client’s well-organized and accurate books were a key factor in their decision.

Why Meticulous Bookkeeping is Vital for Business Success

When your business’s finances are in order, you can confidently manage your cash flow, budget for upcoming expenses, and ensure timely tax payments. This level of organization not only keeps the CRA at bay but also sets your business up for long-term success.

Conclusion

No business owner wants to hear that they’re being audited, but with the right preparation, you can handle an audit with confidence. By using software to keep your business’s bookkeeping organized and partnering with experts like M7 Group, you can minimize the risk of an audit and ensure that your business remains compliant with CRA regulations.

Don’t wait until an audit is on the horizon to take your bookkeeping seriously. Trust M7 Group to help you optimize your financial processes, stay compliant, and avoid the pitfalls of a CRA audit. By taking these steps, you’ll not only protect your business but also set the stage for continued growth and success.

For more information on how M7 Group can assist your business with CRA audits and other tax-related matters, visit our website or contact us today.

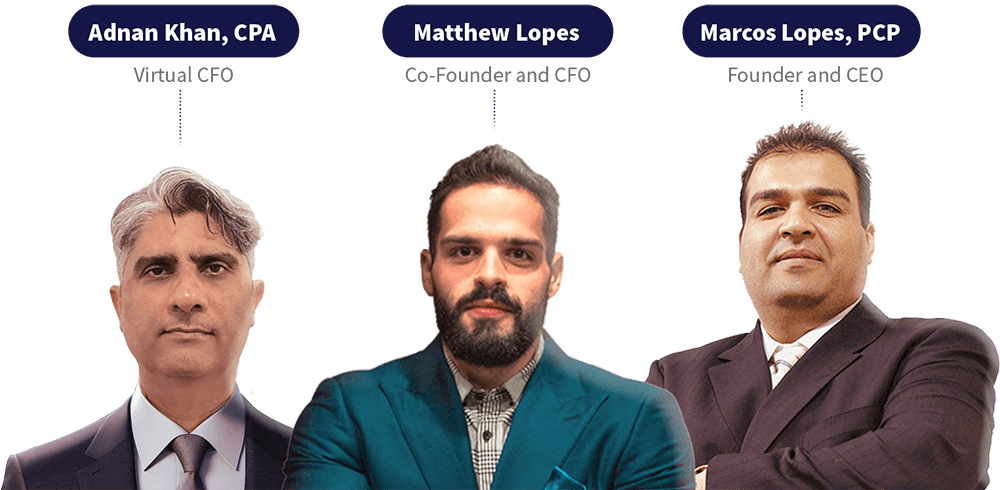

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.