When Can You Relax About Potential CRA Audits? How Far Back Can the CRA Audit Me?

One essential aspect of financial management as a business owner or self-employed individual is maintaining thorough records of your transactions, including receipts, expenses, and proof of payments. At M7 Tax, we emphasize the importance of holding onto these documents for at least seven years. Here’s why this practice can be a lifesaver when it comes to dealing with the CRA and ensuring your business remains in good standing.

The 7-Year Rule: A Safety Net for Your Business

While the CRA typically has a 3-year window to audit your tax returns, they can extend this period under certain circumstances, such as suspected fraud, unreported income, or significant errors. For these reasons, we recommend keeping all relevant financial records for a minimum of seven years. This timeframe covers the standard audit window plus additional years in case of extended audits.

Exceptions to the Rule: Extended Audit Periods

While the 3-year rule offers some peace of mind, there are notable exceptions where the CRA can extend its audit reach. These include:

Suspected Fraud or Misrepresentation: If the CRA suspects that you have committed fraud or made a significant misrepresentation on your tax return, the 3-year limit doesn’t apply. In such cases, the CRA can audit and reassess your returns for any year in which they believe fraud or misrepresentation occurred.

Unreported Income: If you’ve failed to report income of $500 or more in any year, the CRA may extend the reassessment period by an additional three years. This means they could potentially go back six years instead of the usual three.

Non-Filers: If you haven’t filed a return at all, the CRA can go back indefinitely. There is no time limit for the CRA to require you to file a return or to assess taxes for those years.

Why It’s Important to Stay on Top of Your Taxes

Some business owners might be tempted to ignore tax debts, hoping that the CRA won’t notice. However, this approach is risky. The CRA has sophisticated systems for identifying discrepancies and unreported income, and the penalties for failing to report can be severe.

Moreover, even if you think you’ve done everything right, errors can still happen. For instance, if you miss reporting a source of income or claim a deduction incorrectly, the CRA can reassess your taxes and apply interest on the additional taxes owing. These reassessments can be financially damaging, especially if they occur several years after the original filing.

When Can You Relax About Potential CRA Audits?

If you’ve filed your taxes accurately and on time, and you’ve passed the 3-year mark without hearing from the CRA, you can generally relax. However, if you’ve engaged in any of the activities mentioned above, or if you’re unsure about the accuracy of your returns, it’s wise to seek professional advice.

Regularly reviewing your financial records, ensuring compliance with tax laws, and working with a knowledgeable accountant can help you stay on top of your tax obligations and avoid the stress of an unexpected CRA audit.

In summary, while the CRA’s ability to audit is powerful, understanding the time limits and potential exceptions can help you manage your tax responsibilities more effectively. Don’t wait for a surprise reassessment—be proactive in keeping your financial records accurate and up-to-date.

For more information on how M7 Group can assist your business with CRA audits and other tax-related matters, visit our website or contact us today.

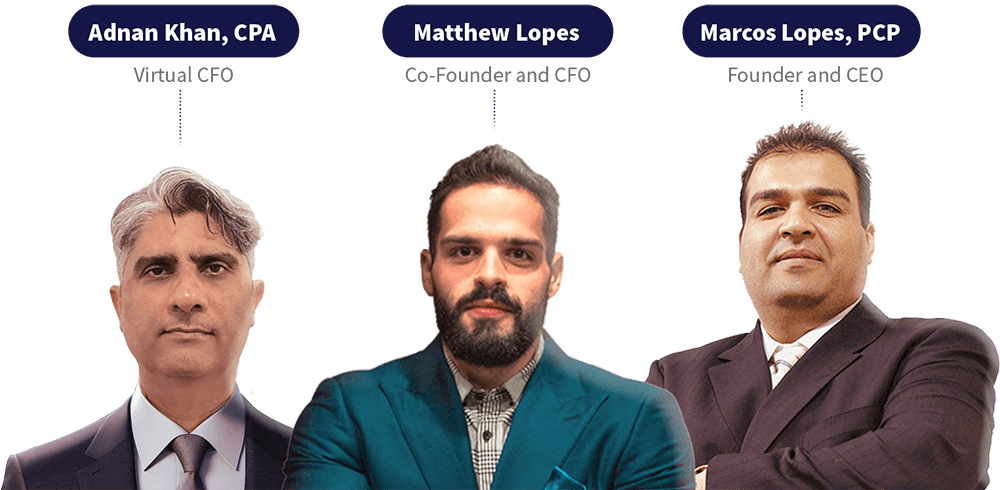

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.