What triggers a CRA audit in Canada and what is the importance of keeping your books in order for the CRA?

You’re blind if you don’t know your business metrics!

We have numerous clients whom we have represented, and thanks to their well-organized books, they received significant refunds.

The Critical Role of Bookkeeping in Business

The importance of keeping your numbers in check

Understanding the metrics and statistics of the business you are running is a powerful tool for predictability. Why do we say that running a business without monitoring numbers is like driving a car with blindfolds on? Because if you can’t statistically measure what’s happening in your business, you won’t know where you’re heading until it’s too late. This means you might not realize you need to correct your course until the moment of impact, and by then, it’s already too late. And this is where we would like to help you: Use software to keep your bookkeeping organized.

One of the most important factors in keeping your numbers up-to-date is having control of your information to be prepared for any surprise audit from the CRA.

Did you know that the CRA completes approximately 70,000 GST/HST audits every year?

The kinder and gentler COVID era is over and the CRA is back and out in full force, auditing businesses throughout Canada!

Count on us! Our team of experts has been doing brilliant work, and we are happy to share our successful cases with you. We specialize in Transportation, Construction, Startups & Entrepreneurs, Wholesalers, Sports & Entertainment, and Food & Beverage. If you don’t see your industry listed, don’t worry! It doesn’t mean we lack experience in it – it simply means it’s not one of the more common industries we serve. If you are in a completely new industry to us, even better! We’re naturally curious and love a challenge.

For more information on how M7 Group can assist your business with CRA audits and other tax-related matters, visit our website or contact us today.

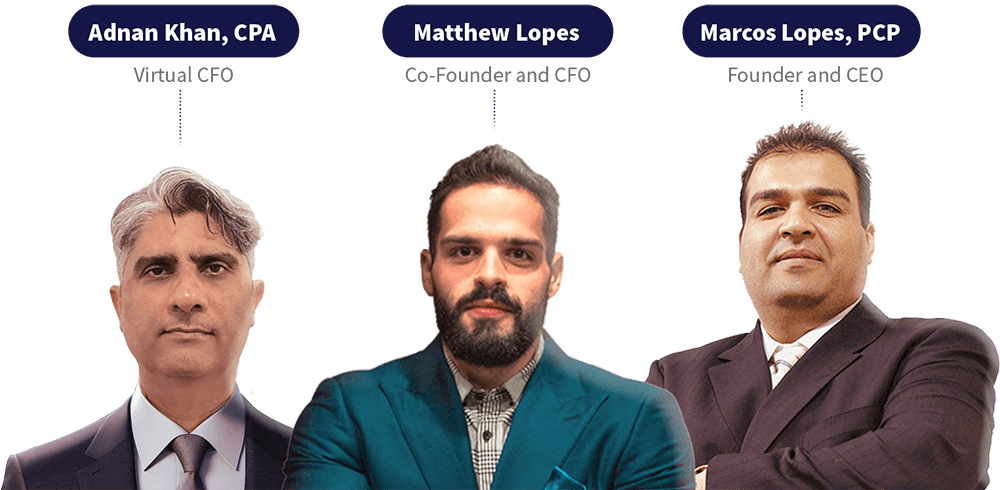

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.