Tax return in Canada

Self-employed tax filing made easy

Are you a freelancer, independent contractor, small business owner, or side hustler? File your taxes your way and maximize your savings.

Step-by-step guidance

Share your details, and we’ll include all the necessary forms for self-employed, freelance, or rental income and expenses.

Maximize every tax break

From home office to vehicle expenses, gas, per diem, and more—we’ll help you claim every self-employment deduction you’re eligible for.

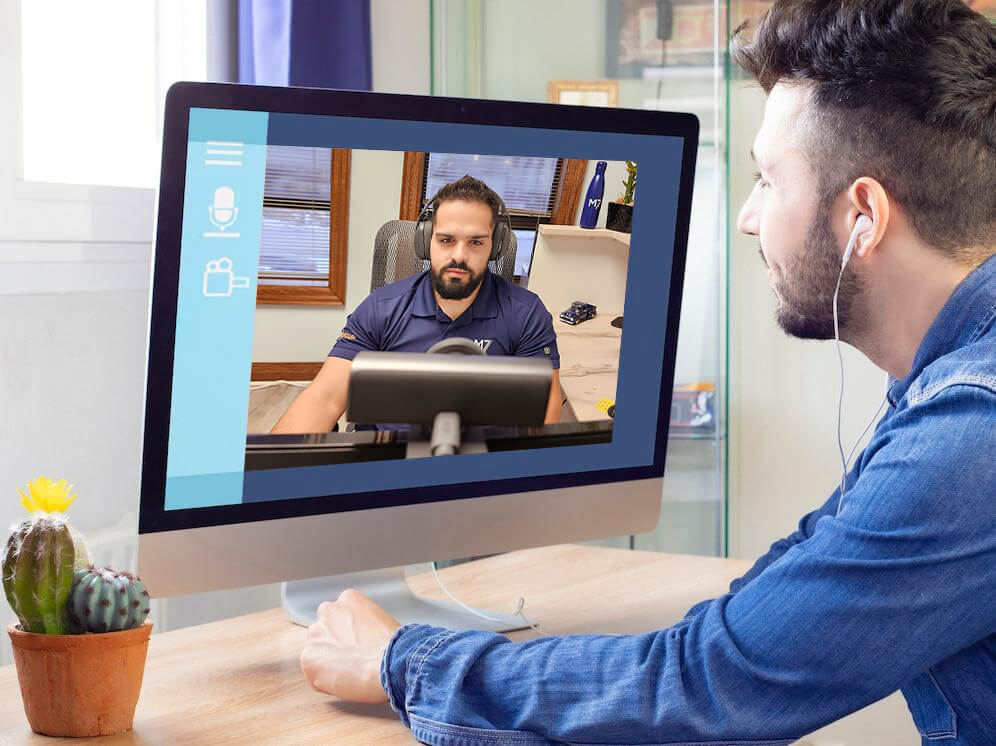

Expert support you

Choose Review & File to get unlimited expert help as you do your taxes, or Full Service to have an expert do them for you.

Filing taxes: What to know

Step 1:

Verify if your income is self-employment

The CRA considers you self-employed if you work as an independent contractor, sole proprietor, or business partner, offering goods or services with the goal of making a profit. This includes freelancers, small business owners, consultants, and gig workers.

Step 2:

Claim every self-employed deduction

Regardless of your self-employed income, you can reduce your tax liability by deducting business expenses.

Step 3:

Know what to track and report

As a self-employed individual in Canada, you're responsible for tracking your income and expenses to file on time and claim the correct deductions.

Step 4:

Achieve the best results with expert assistance, guaranteed*

Need to speak with a real tax expert? With M7 Review & File, you get tax expert help and a final review of your return before filing.

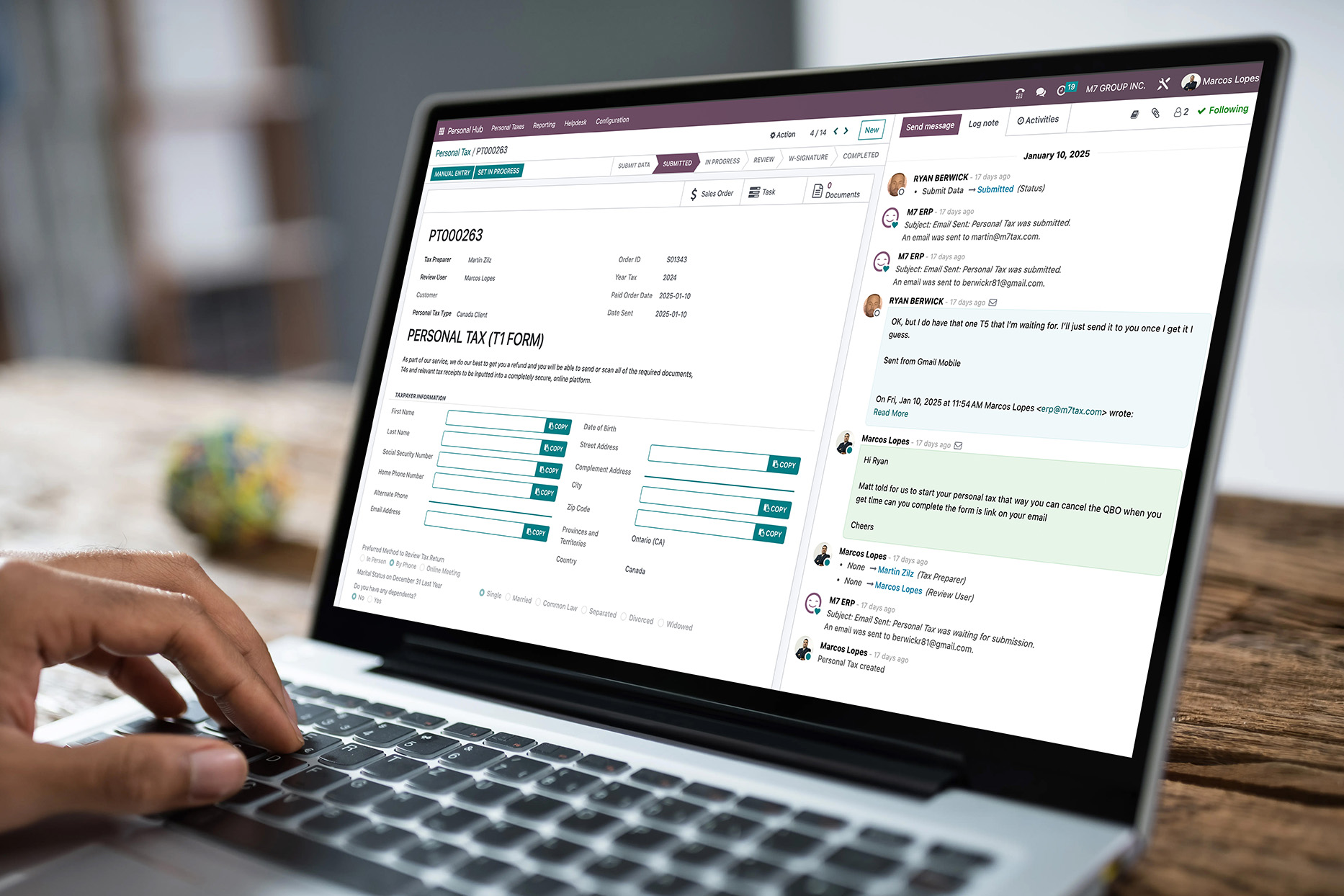

File your taxes online*

in minutes

with an easy tutorial

stress-free

Why M7 Tax Online?

Taxes done for you

A tax expert handles the preparation, review, and filing of your taxes—with 100% accuracy and the best possible outcome, guaranteed*.

Expertise and background in the tax field

Our tax experts have over 12 years of professional experience in tax preparation for Canadians.

Easy Online Service

Let an expert handle your taxes online. From March 3 to April 30, we'll be here to help weekdays from 8 AM to 8 PM, and on Saturdays from 9 AM to 3 PM.

Peace of mind

for up to 7 years*

With Audit Protection, we provide unlimited CRA representation for up to seven years *for the specific tax year

-

Resolve tax debts

-

Address issues with CRA forms

-

Assist with denied credits