PAYROLL SERVICES FOR SMALL BUSINESSES

Automate paydays Stay compliant

with M7™

Payroll services simplify paydays, ensure compliance, and ease year-end tax filing for businesses of any size.

Every payroll package includes your own dedicated accountant

Essential

Suitable for self-employed or solo entrepreneurs.

- Dedicated accountant

- Single-state payroll

- Easy, guided set-up

- Standard reporting

Pro

Suitable for small businesses looking for employee benefits and HR assistance.

- Everything in Advanced, and:

- Workers’ compensation

- HR tools and resources

- Timekeeping

Advanced

Suitable for small businesses with more than one employee.

- Everything in Essential, and:

- Easy pay-out for contractors

- Comprehensive reports

- Accurate T4 and T4A preparation for tax season

WSIB Registration

-

Help open a new WSIB account

-

Guide on required documentation and WSIB needs

-

Initial consultation for compliance and client understanding

WSIB Quarterly Filing

-

Preparation and filing of quarterly WSIB reports

-

Ensuring timely and accurate submission to avoid penalties

-

Keeping track of WSIB premiums and collecting necessary data

-

Offering WSIB charge summaries and insights

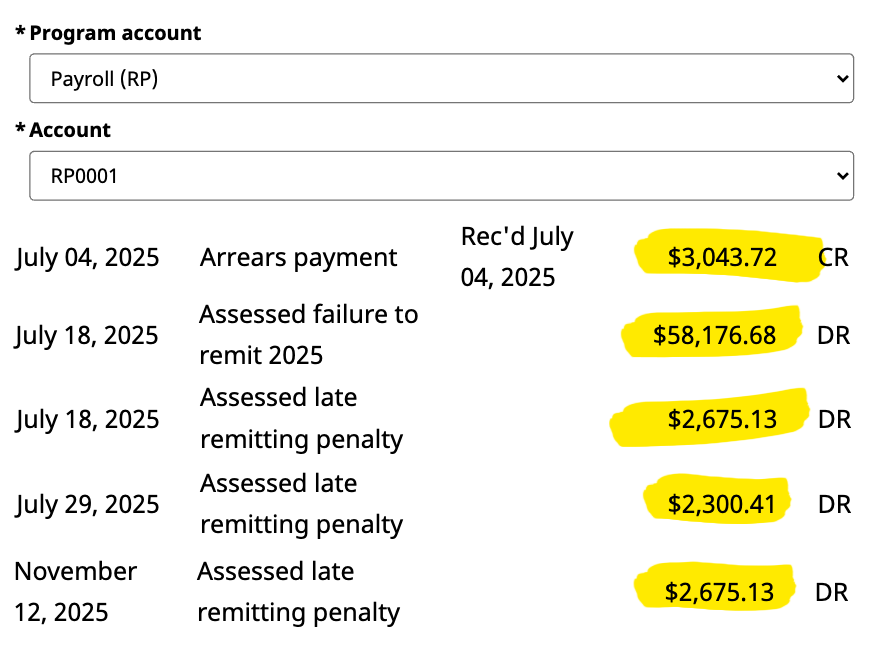

How Payroll Errors Cost Almost $70K in CRA Penalties

And How M7 Reversed It All

Challenge

US Air Compressor Inc., a Canadian industrial equipment company, fell behind on payroll remittances due to internal administrative breakdowns.

This triggered aggressive CRA action:

By 2025, the CRA balance had surged to $68,870.40, placing the business under severe financial strain, with penalties and collections set to keep escalating without professional help.

M7 Solution

M7 executed a disciplined, multi-month CRA resolution strategy designed to challenge the assessment, correct errors, and recover overpaid amounts.

What we did:

✔ Rebuilt historical payroll data from the ground up

✔ Reconciled CRA payroll accounts against actual filings and payments

✔ Identified misapplied payments, errors, and overassessed penalties

✔ Took full control of CRA communication, including repeated calls and follow-ups

✔ Opened a formal CRA review and reassessment process

✔ Submitted detailed documentation and explanations

✔ Guided the client through compliance steps to strengthen credibility with CRA

This process required over five months of continuous CRA engagement, persistence, and technical payroll expertise.

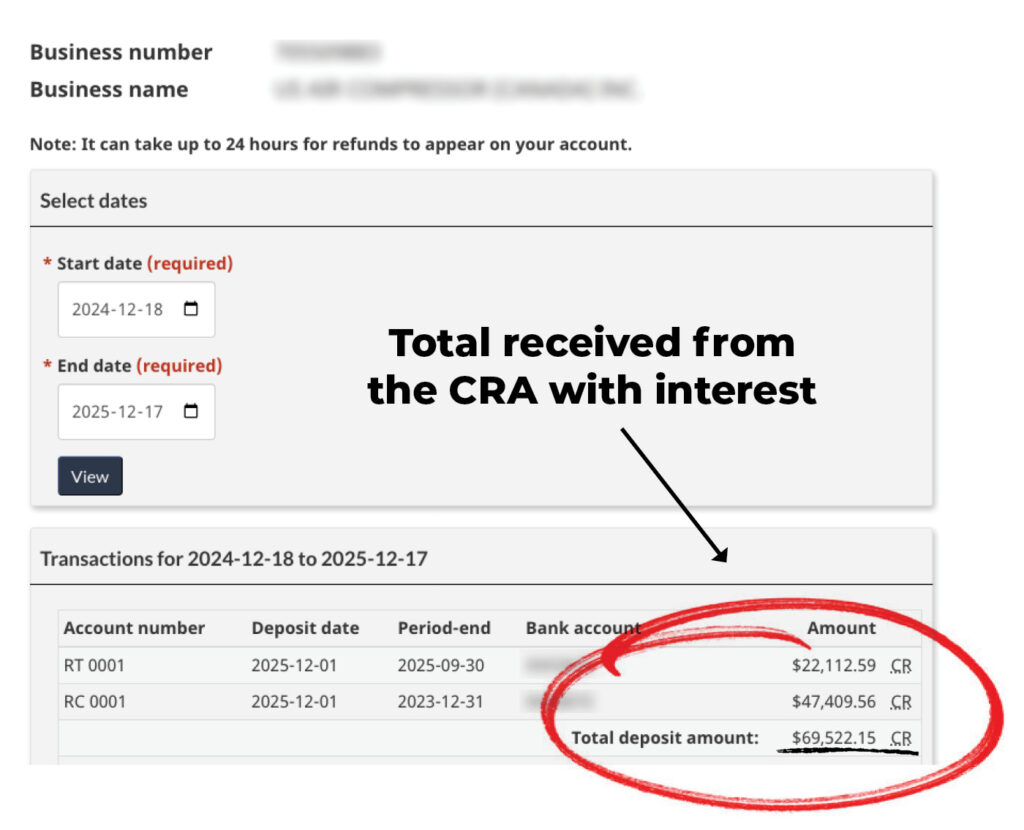

Results

CRA completed its review and issued a full correction.

Final outcome:

December 2024 – December 2025

The client recovered 100% of the assessed amount, eliminated CRA enforcement risk, and restored payroll compliance.

This case proves one thing:

CRA assessments aren’t always accurate, but challenging them effectively requires experts who know how to push back.

US Air Compressor Inc. recovered a significant CRA refund because M7 knows how to push back against the CRA.

How M7 Works

1. Schedule a Free Call

Consult with our team about your unique payroll requirements, and receive a tailored quote during your initial consult.

2. Meet your accountant

Based on your unique business situation, you’ll get access to an accountant who best meets your needs.

3. Get Result

Get back to business! Need to reach your accountant? Connect via phone, video, Odoo discuss App, or email.

Save time, cut costs, and ensure worry-free compliance

Receive a variety of accurate, user-friendly payroll reports. For a small fee, we’ll include union, certified payroll, workers’ compensation reports, and more.

-

Dedicated payroll specialist for your industry in Canada

-

Personalized support for all CRA filings

-

Accurate calculations compliant with Canadian regulations

-

Electronic CRA filing + record keeping

-

24-7 access to your online portal

Key pay elements that impact payroll

-

Workers’ Compensation

-

Minimum Wage & Tips

-

Overtime

-

Payment method

-

Pay Stub Laws

-

Minimum Pay Frequency

-

Paycheck Deduction Rules

-

Final Paycheck Laws

The team behind M7 Services

Marcos Lopes, EA

Founder and CEO

Marcos Lopes, EA

Founder and CEO

This vision led to the creation of M7 Group™, a company dedicated to redefining financial management through innovation and personalized support.

Under Marcos’s leadership, M7 Group™ continues to expand its reach, offering expertise paired with cutting-edge solutions like M7 FuturERP™, M7 Figures™, and ProsperX, all designed to help businesses thrive. With an unwavering focus on innovation, efficiency, and client success, Marcos has positioned M7 Group™ as a trusted partner in financial empowerment and business growth across North America.

- Phone:(800) 771-8244 Ext: 101

- Email:[email protected]

Matthew Lopes

Co-Owner and CFO

Matthew Lopes

Co-Owner and CFO

My role at M7 is to assist my team and clients to navigate the complex world of entrepreneurship through a proper financial plan, analysis and forecast. This is often achieved through various services, software and team development with each client’s unique needs and goals.

As our firm and team continues to grow, I am constantly learning and finding the best approach to structuring the core principles of a business to flourish return and growth for the foreseeable future.

- Phone:(800) 771-8244 Ext: 106

- Email:[email protected]

Adnan Khan

CPA, FCCA - Virtual CFO

Adnan Khan

CPA, FCCA - Virtual CFO

In his professional career, Adnan has worked with a diverse range of clients, especially small businesses, specializing in tax planning, financial analysis. His hands-on experience in managing complex financial portfolios and navigating intricate tax regulations has made him a trusted advisor in the accounting community.

Adnan’s passion for education led him to share his knowledge as an adjunct professor at various colleges in Canada, where he is teaching accounting, business and taxation courses for over a decade. His teaching approach combines real-world applications with theoretical concepts, helping students bridge the gap between classroom learning and professional practice. His dedication to education is reflected in his engaging lectures and mentorship of future accounting professionals.

Adnan’s dual expertise in practical accounting and teaching has positioned him as a well-rounded expert, valued for his ability to provide both practical insights and academic guidance. His contributions to the field continue to influence both his students and peers, making him a prominent figure in the accounting profession.

CPA, CGA (Canada)

CPA (Colorado)

CGMA (USA)

FCCA (UK)

- Email:[email protected]

Salomon Duran

M7 partner in the USA

Carla Cristiane

Accounting Manager

Carla Cristiane

Accounting Manager

My experience in finance, working in healthcare offices, coordinating teams, and providing personalized client service has elevated my skills, enabling me to deliver my best at M7 Group™.

- Phone:(800) 771-8244 Ext: 105

- Email:[email protected]

Kevin Lopes

Accounting Manager

Kevin Lopes

Accounting Manager

At M7 Group™, I oversee payroll services, helping our clients save time and reduce costs. Additionally, I provide support to team members as needed, fostering collaboration and efficiency.

Education

University of Guelph-Humber

Bachelor of Business Administration (B.B.A.), Finance (2014–2018)

- Phone:(800) 771-8244 Ext: 111

- Email:[email protected]

Martin Zilz

Senior Accountant

Martin Zilz

Senior Accountant

- Email:[email protected]

Ravi Gautam

Senior Accountant

Ravi Gautam

Senior Accountant

As a Senior Accountant at M7 Group™, I bring over 3.5 years of expertise in financial planning, analysis, and accounting principles.

I am IFIC-certified and currently preparing for CPA Canada, with a focus on delivering precise financial management solutions and fostering business growth.

Key Expertise:

Financial management, auditing, and budget creation.

Daily financial transaction recording and analysis of organizational finances.

Cost and revenue reporting, forecasting, and budgeting.

Integration of business and finance functions through effective communication.

Skilled in qualitative and quantitative analysis to enhance decision-making.

Proficient in spreadsheet utilization and accounting software, leveraging technology for streamlined processes.

- Email:[email protected]

Alan Inacio

Accounting Manager

Alan Inacio

Accounting Manager

As a highly versatile and results-driven accounting professional, I bring over 5 years of experience in managing accounting operations across various tax regimes in Brazil. At M7 Group™, I specialize in delivering comprehensive accounting solutions, ensuring compliance, and fostering team growth.

Key Expertise: Tax analysis and bookkeeping across all tax regimes. Preparation and submission of monthly and annual statements. Accounting entries, financial statements, balance sheet closings, and income statements. Client consulting and advisory services, offering tailored financial solutions. Training and mentoring new team members, fostering continuous professional development.

Education MBA in Business Management, UNISUL, Brazil (2015) Bachelor’s Degree in Accounting Sciences, São José Municipal University Center, Brazil (2012)

- Email:[email protected]

Marco Aurélio

Accountant

Marco Aurélio

Accountant

- Email:[email protected]

Wendel Almeida

Bookkeeper

Wendel Almeida

Bookkeeper

Currently contributing to M7 Group™, I am a strategic and results-oriented professional with expertise in business management, financial operations, and team leadership. With a strong background in retail, finance, and logistics, I excel in developing efficient processes that drive organizational success.

EDUCATION

Bachelor’s in Economics - UEFS (2020–2024)

CERTIFICATIONS & COURSES

Business Management (2018–2020): Specialized in HR, accounting, marketing, and secretariat functions.

Advanced Excel, Intermediate Power BI, and Facebook Ads expertise.

- Email:[email protected]

Bhawesh Bisht

Bookkeeper

Bhawesh Bisht

Bookkeeper

At M7 Group Inc., I specialize in leveraging my skills to help businesses achieve financial clarity and sustainable growth. My background includes extensive experience in accounting software, financial data analysis, and preparing detailed financial statements.

Education

Bachelor's Degree in Commerce, specializing in Accounts and Taxation

Computer Diploma

- Email:[email protected]

Daniel G.

Bookkeeper

Daniel G.

Bookkeeper

I am an experienced professional currently working at M7 Group™, specializing in bookkeeping, financial analysis, and business growth strategies. My background spans various industries, including automotive, aviation, and technology, with expertise in finance, cost estimation, data analysis, manufacturing, continuous improvement, project management, and tooling and machining.

EDUCATION

Bachelor’s Degree in Business

Administration

Postgraduate in Project Management

Specialization in Data Analysis

Green Belt Lean Six Sigma Certification

Work Experience

Embraer

LG

- Email:[email protected]

Marcel Canhada

Bookkeeper

Marcel Canhada

Bookkeeper

Currently contributing to the success of M7 Group™, I bring over 15 years of expertise in accounting, business administration, and financial analysis. My diverse experience spans roles in financial management, strategic planning, and tax compliance, with a focus on delivering tailored solutions to clients.

Key areas of expertise include:

Business plan, balance sheet, and profit-and-loss statement preparation and analysis.

Financial reporting, audits, and tax management.

Proficiency in accounting software, Microsoft Office, and public accountability processes.

EDUCATION

Telecommunications Technician, CEFET-RS, 2002

Bachelor’s in Business Administration, ESPM-RS, 2006

Business Management in Agribusiness, UFPEL-RS, 2009

LANGUAGES

English and Spanish

- Email:[email protected]

Anna Lira

Client Success

Anna Lira

Client Success

Anna Lira is an experienced professional in administrative roles, with a focus on procurement. She has a strong background in various administrative activities, including logistics, sales, quality, and project management. Anna aims to continue working with diverse administrative tools and activities, primarily focusing on procurement, logistics, sales, quality, and project management.

- Email:[email protected]

Denilson U.

Marketing

Denilson U.

Marketing

- Email:[email protected]

Rodrigo Genz

Developer

Rodrigo Genz

Developer

Currently, my passion lies in ERP Project Design & Management. I specialize in implementing, training, and managing Odoo-based solutions, helping businesses streamline operations and achieve their goals. Whether it’s designing seamless user experiences or leading complex projects, I thrive on bringing ideas to life and empowering others through technology.

- Email:[email protected]

Tatiany Mori

Developer

Tatiany Mori

Developer

As a Developer, I specialize in Odoo, leveraging my expertise to drive team and company success.

Key responsibilities: - Process Analysis & Mapping: Collaborating with business teams to identify needs, address bottlenecks, and optimize workflows. - Module Implementation: Designing and developing new Odoo modules tailored to business requirements. - Module Customization: Enhancing existing modules to meet organizational demands.

I create custom addons, deliver technical solutions, and improve user experiences with Python, JavaScript, HTML, and CSS.

- Email:[email protected]

Need help with Payroll? Start Here

Yes. In Canada, payroll taxes include:

- Canada Pension Plan (CPP) contributions

- Employment Insurance (EI) premiums

- Income tax deductions

- Provincial payroll taxes (applicable in certain provinces)

Employers are responsible for withholding these amounts from employees' wages and remitting them to the Canada Revenue Agency (CRA).

Payroll compliance in Canada refers to the legal obligations employers must follow regarding employee compensation, deductions, and reporting. This includes:

- Deducting and remitting income taxes, CPP, and EI

- Maintaining accurate payroll records

- Issuing T4 slips to employees and T4 summaries to the CRA

- Following provincial employment standards on wages, overtime, and vacation pay

- Complying with workers' compensation and other payroll-related regulations

Failure to comply can result in penalties and interest charges from the CRA.

Payroll compliance in Canada is regulated by:

- Canada Revenue Agency (CRA): Oversees payroll deductions, tax remittances, and reporting.

- Employment and Social Development Canada (ESDC): Enforces federal labor standards.

- Provincial/Territorial Ministries of Labour: Regulate employment standards, such as minimum wage and overtime rules.

Some provinces also have additional payroll tax requirements, such as Ontario’s Employer Health Tax (EHT) and Quebec’s CNESST contributions.

No, a Business Number (BN) issued by the CRA is a permanent identifier for tax purposes. However, you can close specific CRA accounts (such as payroll, GST/HST, or corporate tax) if your business is no longer operating.

To close a payroll account, you must:

- File all outstanding payroll remittances and T4 slips.

- Send a request to the CRA through your online account or by mail, providing your BN, business name, and reason for closure.

Even after closing, the BN remains on record with the CRA for future reference if needed.

Employers in Canada must contribute to:

- Canada Pension Plan (CPP): Matching employee contributions (5.95% in 2024, up to the maximum pensionable earnings limit).

- Employment Insurance (EI): Employer portion (1.4 times the employee contribution, up to the annual maximum).

- Provincial payroll taxes: Some provinces impose additional employer taxes, such as:

- Ontario Employer Health Tax (EHT)

- Quebec Parental Insurance Plan (QPIP)

- Manitoba and Newfoundland & Labrador payroll taxes

The total payroll tax burden varies depending on the province and the employee’s earnings.