How we Saved $120k for a Client: The Importance of Proper Expense Reporting in CRA Audits

In the world of business, even small mistakes can lead to significant financial repercussions. One such error—incorrectly recording business expenses under a personal name—almost cost our client $120,000. However, thanks to our thorough understanding of the tax code and a diligent advocacy approach, we successfully protected this substantial sum, turning a potential disaster into a victory.

The Case: A Mistake in Expense Reporting

Our client, based in Quebec, was facing a serious issue. Some of their business expenses had been mistakenly recorded under their personal name instead of their business’s name. While this might seem like a minor oversight, it could have led to the CRA disallowing these expenses, resulting in a hefty financial burden. The situation underscored the importance of meticulous record-keeping and the potential consequences of even the smallest errors in reporting.

The Outcome: A $120k Victory

Our diligent efforts paid off. The CRA recognized the validity of our argument and accepted that the expenses were legitimate business expenses, despite the initial misclassification. As a result, the expenses were not removed from the client’s return, saving them $120K.

In a letter from the CRA, they explicitly noted that the client’s well-organized and accurate books played a crucial role in their decision. This case serves as a powerful reminder of the importance of proper expense reporting and the value of maintaining meticulous financial records.

The Lesson: Why Proper Record-Keeping Matters

This case highlights the critical role that accurate, well-organized financial records play in protecting your business. While mistakes can happen, having clear documentation and a thorough understanding of the tax code can make all the difference when dealing with the CRA. For businesses, a simple error in how expenses are reported can lead to a loss of valuable tax deductions and significant financial stress. However, with expert guidance and diligent record-keeping, these risks can be minimized or even eliminated.

Let Us Help You

At M7 Tax, we specialize in navigating the complexities of tax compliance and protecting your business from costly mistakes. Whether you’re facing a CRA audit or just want to ensure your records are accurate, our team is here to help. With our expertise, you can focus on growing your business, knowing that your financial affairs are in good hands.

Your business could be next. Contact us today and let us help you achieve peace of mind and financial security. For more insights, check out our latest success story: From $3K Owed to $15K Refunded: A Successful CRA Audit Outcome.

For more information on how M7 Group can assist your business with CRA audits and other tax-related matters, visit our website or contact us today.

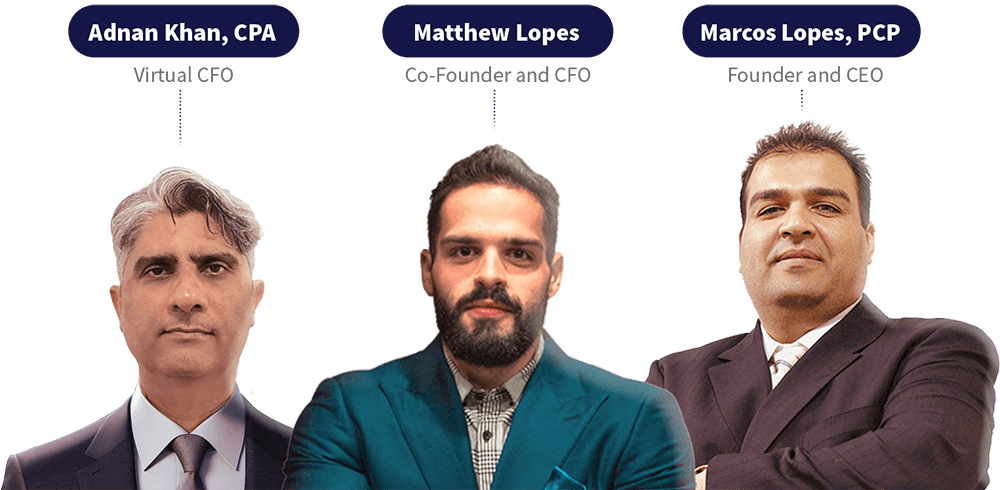

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.