How to Pay Taxes as Self employed in Canada?

Being self-employed in Canada comes with unique advantages and responsibilities. According to the Canada Revenue Agency (CRA), self-employment includes earning income from a business, profession, commission, farming, or fishing activity that you operate on your own or with a partner.

Benefits and Responsibilities of Self-Employment

Self-employment offers several perks, such as increased flexibility, autonomy, and creativity. Additionally, you can deduct specific expenses from your income to lower your tax liability. However, it also entails obligations like maintaining accurate records of your income and expenses, timely tax payments, and filing the appropriate tax forms.

Setting Aside Taxes

As a self-employed individual, it’s crucial to set aside funds for taxes, particularly for the Canada Pension Plan (CPP) and Employment Insurance (EI) premiums. Unlike employees, who have taxes deducted directly from their paychecks, self-employed individuals must calculate and remit their taxes, either quarterly or annually. This can be complex, especially if you’re not well-versed in the tax regulations and rates applicable to self-employed Canadians.

Types of Taxes for the Self-Employed in Canada

Self-employed individuals or independent contractors in Canada may be subject to two main types of taxes: income tax and GST/HST.

1. Income Tax

Income tax is levied on your net income (total income minus expenses) for the year. The amount you owe depends on your tax bracket, which is influenced by your taxable income and your province or territory of residence. Current tax rates and brackets are available on the CRA website.

As a self-employed individual, you must file two forms:

- T1 General: The standard form for personal income tax.

- T2125 Statement of Business or Professional Activities: This form requires you to report:

- Total revenue from your business or profession.

- Expenses incurred for goods and services related to your business.

- Deductions for depreciation and other allowable expenses.

- Net income or loss from your business.

2. GST/HST

Goods and Services Tax/Harmonized Sales Tax (GST/HST) applies to most goods and services sold or provided in Canada. Businesses collect GST/HST and remit it to the CRA. The rate varies by province or territory, and current rates can be found on the CRA website.

Navigating tax obligations as a self-employed individual can be challenging. However, understanding the basics and staying organized makes the process more manageable. At M7 Group, we help self-employed individuals manage their taxes effectively.

Our experts provide detailed guidance and up-to-date tax information to keep you compliant with the latest regulations. While referring to the CRA’s official resources is essential, M7 Group offers personalized support tailored to your needs.

With M7 Group, focus on growing your business, knowing your financial and tax matters are in capable hands. Let us simplify your tax journey and give you peace of mind.

Read more about Corporate Tax.

For more information on how M7 Group can assist you, and other tax-related matters, contact us today.

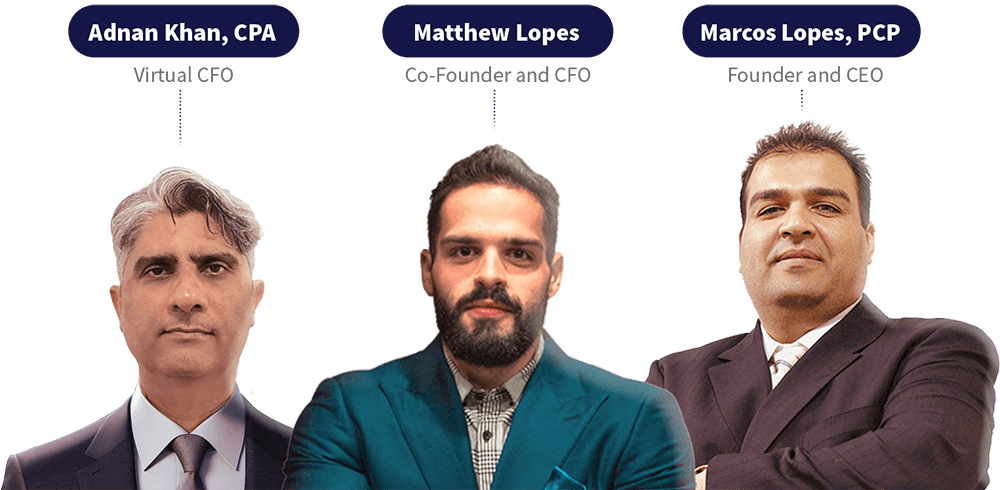

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.