From $3k Owed to $15k Refunded: A Successful CRA Audit Outcome

The Challenge: CRA Audit and a $3,000 Demand

The trucking case

Our client, a trucking company, was audited by the CRA, which initially demanded a payment of $3,000 for GST/HST discrepancies. This demand was not only unexpected but also posed a significant financial strain on the business. The trucking industry, known for its complex financial transactions and unique tax considerations, often faces scrutiny during audits. Our client’s situation required a thorough and strategic response to challenge the CRA’s findings.

How M7 Group Can Help Your Trucking Business

Expertise in the Trucking Industry

Comprehensive Documentation Support

Accurate records are key to audit success. Our team ensures meticulous documentation, making financial transactions easily accessible and aiding in both audit defense and financial management.

Tailored Audit Strategies

Every business and audit is unique. We develop tailored strategies for your specific audit circumstances, whether it’s a GST/HST assessment or another tax issue. Our goal is to minimize liabilities and maximize refunds, keeping your business financially healthy.

Ongoing Compliance and Advisory Services

Beyond audits, we offer ongoing compliance and advisory services to navigate complex tax regulations. From financial reviews to strategic tax planning, M7 Group is your partner in maintaining compliance and achieving financial success.

Conclusion

The success story of our trucking industry client illustrates the significant impact that expert audit resolution can have on a business. At M7 Group, we are dedicated to delivering exceptional results through meticulous documentation, industry-specific expertise, and strategic advocacy. If your trucking business is facing a CRA audit, trust us to turn challenges into opportunities and secure the best possible outcome for your company.

For more information on how M7 Group can assist your business with CRA audits and other tax-related matters, visit our website or contact us today.

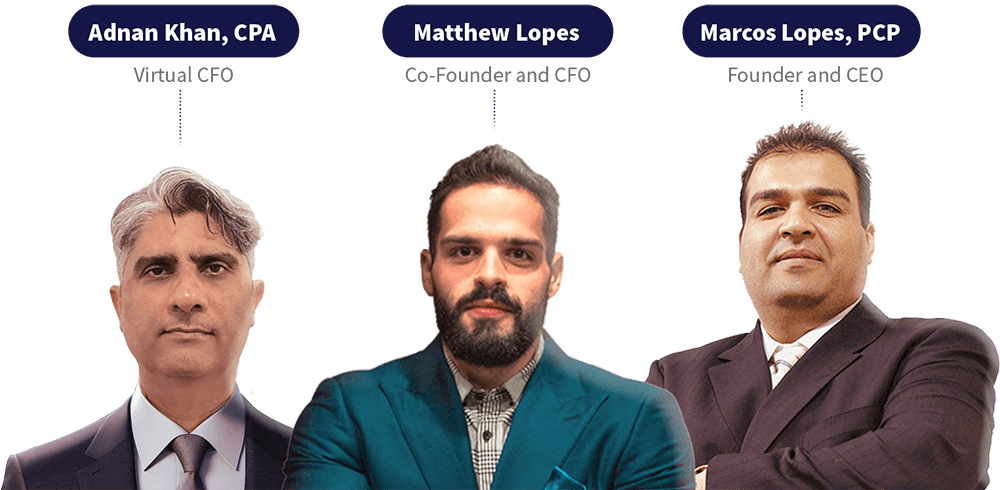

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.