Don’t Lose Sleep Over a CRA Audit! Let Us Handle It for You! 💤

Receiving an audit notice from the CRA can be one of the most stressful experiences for a business owner. The thought of combing through financial records, responding to countless inquiries, and worrying about potential penalties can leave anyone feeling anxious. But here’s the good news – you don’t have to face it alone. Our expert team is here to help!

Why You Shouldn’t Worry About a CRA Audit

If you’ve been selected for a CRA audit, you’re not alone. Thousands of Canadian businesses are audited every year. It doesn’t necessarily mean you’ve done anything wrong, but it does mean you’ll need to provide accurate information and communicate effectively with the CRA. This is where we step in to handle the heavy lifting for you.

We understand how the CRA operates and what they’re looking for in an audit. Our team will thoroughly review your case, strategize the best approach, and manage all communications with the CRA. You can rest assured that your business’s interests will be protected throughout the process.

Our CRA Audit Protection Service

When it comes to audits, preparation and organization are key. Our CRA Audit Protection Service offers peace of mind by ensuring that your records are in order and that you’re ready to respond to any CRA inquiries. Here’s how we help:

Comprehensive Review: We start by carefully reviewing your financial statements and tax filings to identify any potential issues that could raise red flags. By doing this upfront, we can prepare a strong defense and make sure you’re in the best position to respond to the audit.

Strategy Development: Every audit is unique, which is why we develop a customized strategy for your case. Whether it’s clarifying certain transactions or providing additional documentation, we’ll have a solid plan in place.

Expert Representation: The last thing you want to do is spend countless hours communicating with the CRA. Let us take that burden off your shoulders. We’ll handle all correspondence, negotiations, and discussions, so you don’t have to.

Ongoing Support: Even after the audit, we’re here to assist you. We’ll make sure any follow-up actions are handled efficiently, and we’ll guide you through any adjustments that need to be made in your accounting practices moving forward.

Why Wait? Let’s Resolve Your Tax Issues Today!

It’s tempting to hope that your tax issues might go unnoticed, but waiting can lead to more complications down the road. Instead of playing the waiting game, take action now. Our team will help you resolve any issues with the CRA and keep your business running smoothly.

We know how important your business is to you, and we’re committed to helping you protect it. With our CRA Audit Protection Service, you can focus on what you do best – growing your business – while we handle the audit for you.

Stay Protected, Stay Organized

Our personal and Corporate CRA Audit Protection isn’t just a service – it’s a reassurance that no matter what comes your way, we’ve got your back. With us in your corner, you can sleep soundly, knowing that your business is in safe hands. Don’t let a CRA audit disrupt your peace of mind. Reach out to us today, and let’s tackle your tax issues together!

For more information on how M7 Group can assist your business with CRA audits and other tax-related matters, visit our website or contact us today.

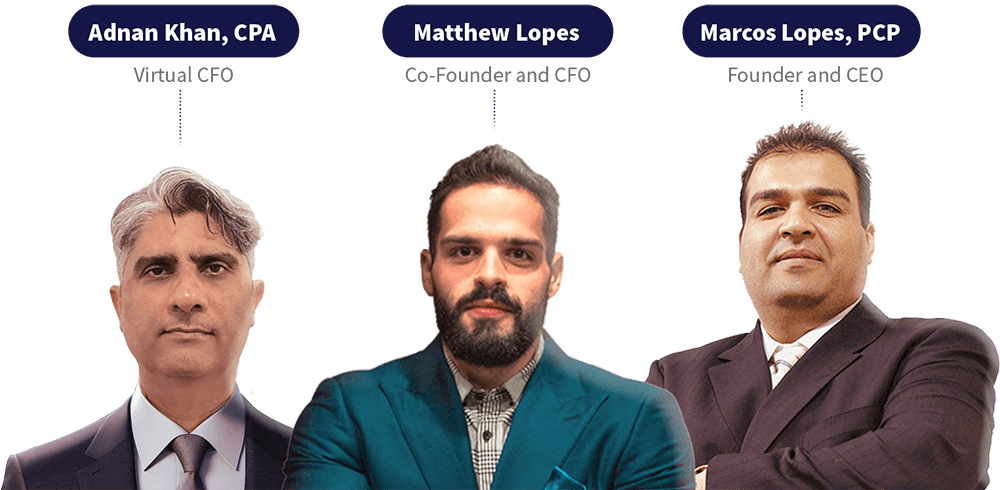

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.