Don’t Let CRA Take Your Wealth: Strategies to Keep More Cash in Your Pocket!

Tax season is just around the corner, and if you’re not prepared, Uncle Sam will gladly take more of your hard-earned money. But why let that happen? At M7 Tax, we don’t just help you file your taxes—we help you maximize your refund and keep as much of your cash as possible! You work hard for your money, and we’re here to make sure you don’t give more than you need to.

Tax Season 2025: Key Deadlines for Canadians 🇨🇦

Before we dive into tax-saving strategies, mark these important dates on your calendar. Missing them could mean penalties and lost opportunities for deductions and credits!

📅 March 1, 2025 – Deadline to contribute to your RRSP for the 2024 tax year.

📅 April 30, 2025 – Deadline to file your 2024 personal income tax return and pay any balance owing.

📅 June 15, 2025 – Filing deadline for self-employed individuals (but any taxes owed must be paid by April 30).

🚨 Don’t risk penalties! Stay ahead of deadlines, maximize your refund, and make tax season work for you.

Ready to Keep More of Your Money? Here’s How 🇨🇦

At M7 Tax, we don’t just crunch numbers—we dig deep into every tax-saving opportunity to help you keep more money in your pocket. Here are some key strategies to avoid overpaying:

1️⃣ Max Out Deductions and Write-Offs—Stop Overpaying!

Are you claiming every possible deduction? Most Canadians aren’t. Whether it’s:

✔ Home office expenses

✔ Medical and dental costs

✔ RRSP contributions

✔ Childcare expenses

✔ Charitable donations

Every missed deduction means more money going to the CRA instead of your pocket. Let’s fix that!

2️⃣ Claim Every Tax Credit—Cash in Your Pocket!

Why just reduce taxable income when you can knock dollars off your tax bill with credits? We make sure you don’t miss out on:

✔ Canada Child Benefit (CCB)

✔ Climate Action Incentive (CAI)

✔ Disability Tax Credit (DTC)

✔ Tuition and Education Credits

💰 Tax credits = real money back in your hands. Let’s make sure you get every penny.

3️⃣ Slash Your Taxable Income with Smart Retirement Contributions

Why pay taxes on money you could be saving for your future? Contributing to an RRSP lowers your taxable income while building wealth.

📌 Bonus: You may even get a refund by maxing out contributions before the deadline!

4️⃣ Business Write-Offs: Reduce Your Business Taxes

Entrepreneurs, are you fully leveraging tax write-offs? If you’re not claiming:

✔ Home office expenses

✔ Vehicle and travel costs

✔ Marketing and advertising expenses

✔ Business meals and entertainment

…then you’re paying too much. We’ll help you maximize deductions and reduce taxes.

Want More? Download Our Free eBook and Save Even More Money!

Ready to really take control of your tax savings? Download our free eBook now: Tax Secrets Unveiled: Maximize Your Returns and Keep More of What You Earn. In this guide, we reveal insider tips on deductions, write-offs, and strategies that most taxpayers overlook.

Don’t Let CRA Take What’s Yours—Act Now!

Time is ticking, and the more you wait, the more likely you are to lose money. M7 Tax is here to make sure you don’t pay a penny more than you need to. Our team of experts specializes in helping you maximize your return and keep more of what you’ve earned. Why give your money away when you can legally pay less?

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

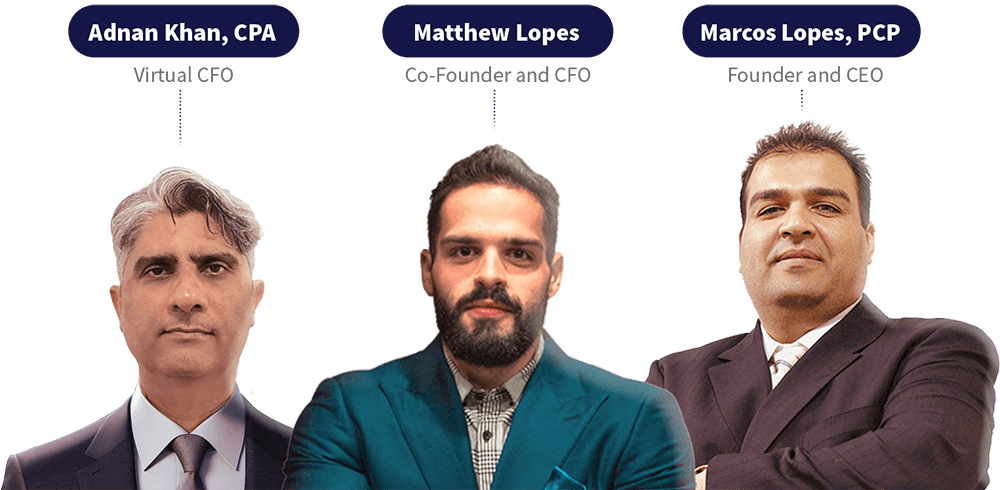

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.