Did your tax refund fall short? Maximize Your 2025 Tax Refund: Start Planning Now!

With the tax deadline behind you, now is the time to look ahead. Want to make sure you get the most out of your refund next year? Waiting until tax season is too late to make impactful changes. By taking action today, you can set yourself up for success and get ahead of the game. Here’s how you can make proactive adjustments to maximize your refund for 2025.

Adjust Your Tax Withholding

One of the most effective ways to ensure a bigger refund is by adjusting your tax withholding now. Many people get hit with a surprise bill come tax season because they didn’t withhold enough during the year. By revisiting your W-4 and increasing your withholding, you can ensure that more taxes are paid upfront, reducing the risk of a hefty bill in the spring.

A small adjustment today can result in a bigger refund next year. Instead of stressing about owing money, you can look forward to receiving a refund or, at the very least, breaking even. 👉 Click to learn more about personal or corporate tax.

Track Your Deductions All Year

Another key to maximizing your refund is keeping track of your deductions throughout the year. Don’t wait until tax season to scramble for receipts! Start now by organizing your documents. Set up a dedicated file labeled “Current Tax Info” and drop in any receipts or records of deductible expenses you come across.

Whether it’s business expenses, charitable donations, or home office deductions, having everything in one place will save you time and help you claim every deduction you deserve. This simple system ensures you don’t leave money on the table when tax season rolls around.

Take Advantage of Tax-Advantaged Savings

Want to boost your refund and save for the future? Contribute to tax-advantaged accounts like a 401(k) or IRA. In 2024, you can contribute up to $23,000 to your 401(k), with an additional $7,500 catch-up contribution if you’re over 50. This not only helps build your retirement savings but also lowers your taxable income.

For business owners, a SEP IRA offers even more opportunities for tax savings. You can contribute up to 25% of your earnings, up to a maximum of $69,000, and deduct these contributions as business expenses.

Stay Ahead with M7 Tax

Why wait until the last minute? At M7 Tax, we help you take control of your finances all year long. By staying proactive and adjusting your strategies now, you can boost your 2025 refund and avoid any last-minute stress.

Book a FREE 15-minute consultation with our experts today! Let’s ensure you’re on track for a bigger refund next year. Don’t wait – start planning now! Want More? Download Our Free eBook and Save Even More Money!

Download our eBook, give us a call, and let’s make this tax season the most profitable one yet! And if you need help, don’t hesitate to seek PROFESSIONAL ASSISTANCE to keep your business on the right track.

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

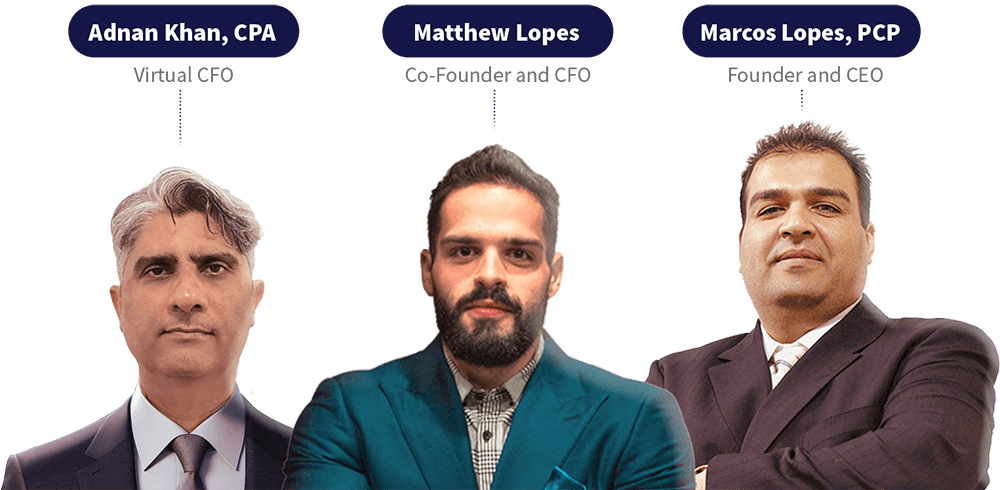

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.