Canadian Truck Drivers: Stop Leaving Your HST Refund on the Table

A lot of owner-operators and truck drivers think they’re safe skipping HST filing because they cross the border so much

But here’s the truth: if you’re paying for fuel, repairs, insurance, and parts, most of that has HST built in. If you’re not filing, you’re handing that money back to the CRA every single year. 💸

We’ve seen drivers leave hundreds of thousands, even millions, sitting on the table because nobody told them they could claim it back. One proper filing can change your cash flow fast, especially if it’s been years since you last claimed.

Why This Matters

If your gross income in Canada is over $30,000, you may be legally required to register for HST. Too many truckers and small business owners skip it, unknowingly handing the CRA thousands every year. That’s money you’ve already paid on:

Fuel

Repairs & maintenance

Truck leases & financing

Insurance premiums

It’s your money. Don’t let it sit in government accounts when it could be in yours.

Know When You Must Register

The magic number is $30,000 in gross revenue (Canadian-sourced). Once you pass that, you must get an HST number. No HST number = No refund.

Even if you’ve paid tens of thousands in tax, without registration you can’t claim it back.

Track every expense

Every fuel-up, every repair, every lease payment includes tax. If you skip receipts or lose them, you lose money. Here’s how to stay on top:

Keep every receipt

Scan them monthly

Match them to your statements

Store them digitally in case the CRA asks

File It Properly

Refunds aren’t automatic. You need to:

File on time

Include all backup records

Avoid late or sloppy submissions

Messy filing can cause delays, trigger audits, or even cause the CRA to deny your claim.

If you skip HST registration and filing, you end up overpaying on every expense and missing out on significant refunds you’re entitled to. Once your revenue passes the $30,000 mark, failing to register also puts you at risk of a CRA audit. For many drivers, this mistake costs tens of thousands of dollars every single year.

Stay compliant. Stay organized. Get your refund.

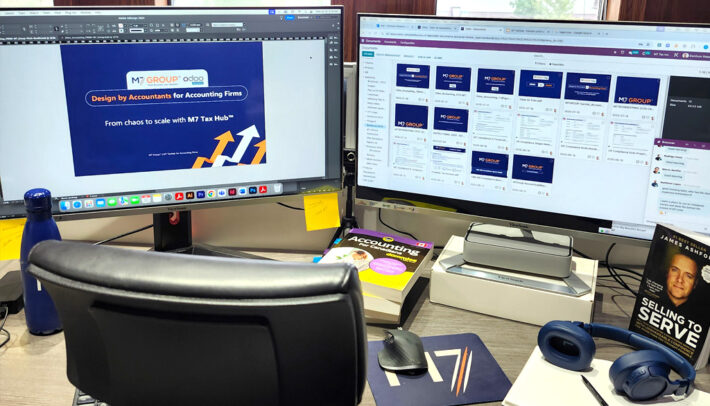

If you want a professional to set up your HST, keep your records organized, and maximize your refund, book your free 15-minute strategy call with M7 Group today. We’ll show you how to turn unclaimed HST from past years into a real cash boost for your business.

Need help figuring out which expenses to cut, and which to grow?

M7 works closely with business owners and beyond to build confident, data-driven financial systems.

📞 Book a free consultation and start scaling smarter from day one.

📧 Have questions? Write to us at: [email protected]