Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

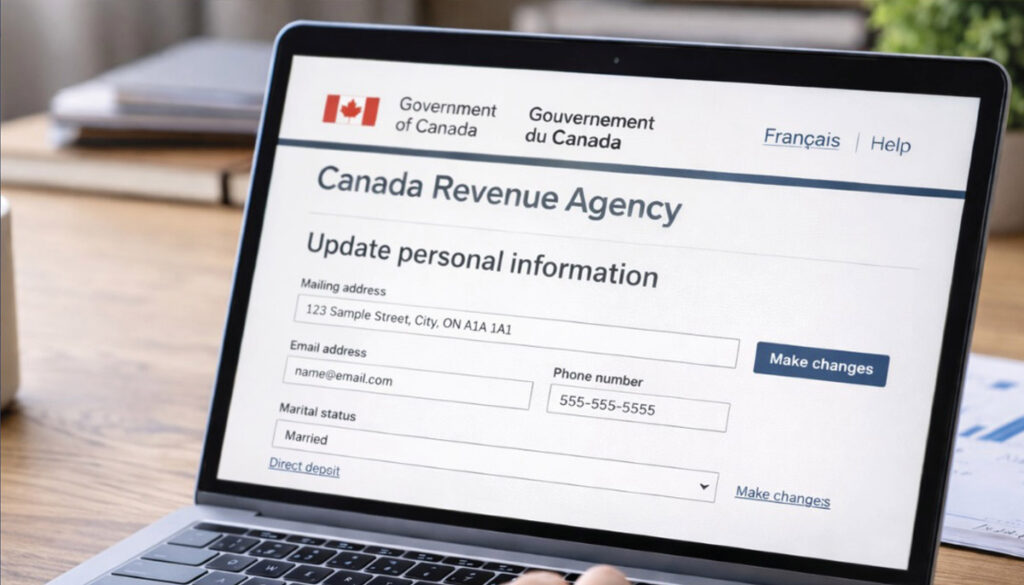

Avoid Tax Season Delays by Keeping Your CRA Account Up To Date

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

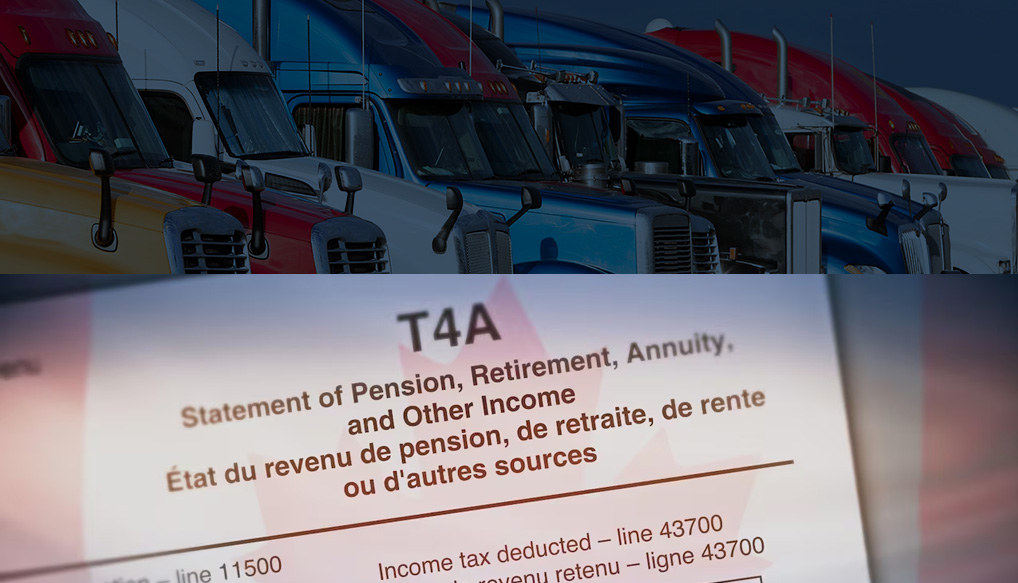

New T4A Reporting Requirement for Truck Drivers: What You Need to Know for 2025

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

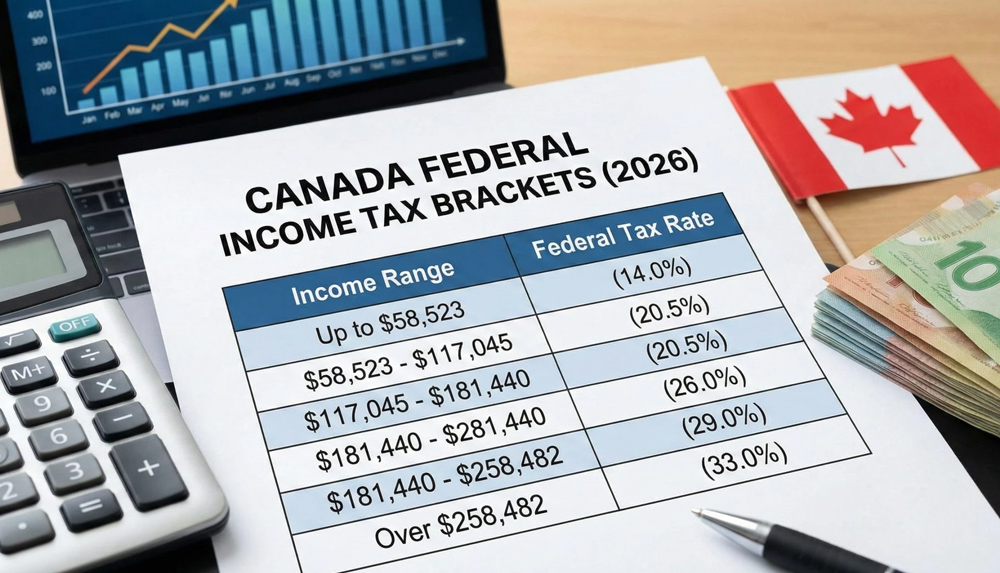

A Tax Refund Is Not a Bonus. It Is a Strategy.

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

Accounting 101 for Canadian Business Owners

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

Growth in Trucking Comes From Real Solutions, Not Guesswork

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

2026 Canadian Tax Brackets: How the New Rates Help You

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

The smartest business owners don’t wait for tax season, they win it early

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

Most Business Owners Overpay Thousands in Taxes

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

The CRA Still Requires Filing, Even When Income Is Low

Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.