Expert Personal Tax Services in Mississauga for Maximum Savings and Compliance

Professional personal tax services in Mississauga to help you maximize deductions and ensure compliance. Trust our expert team for accurate tax preparation and personalized financial advice

File your taxes in Mississauga with 100% accuracy

Answer a few questions, autofill your return with tax slips from the CRA, and M7 Tax Pro does the rest to optimize your return

Basic

DIY and stay compliance with CRA

- Covers employment, unemployment, and pension income

- Step-by-step guidance

- Import slips directly from CRA or scan slips using our AI tool

*Prices do not include a 13% tax, which will be added at checkout.

plus

Basic audit protection

- Everything in Basic, add:

-

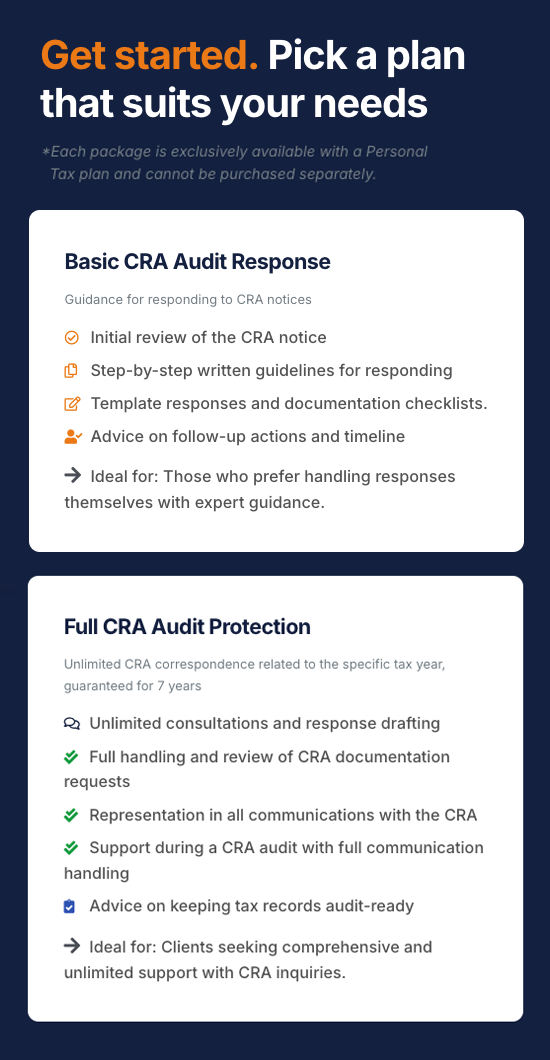

Basic Tax Audit Protection

Guidance for responding to CRA notices.

M7 PRO (Self-employed)

Personal and business income taxes

- Everything in Basic, add:

-

Basic Tax Audit Protection

Guidance for responding to CRA notices.

- Report self-employment, contract, and side gig income

- Report rental income

Why M7 Tax Online?

Simple tax returns

Have a simple tax situation? M7 Tax has you covered. Start your simple tax return for $0.

Maximum refund guaranteed*

M7 maximizes your refund by finding every deduction and credit you qualify for (or get you the lowest tax payable.)

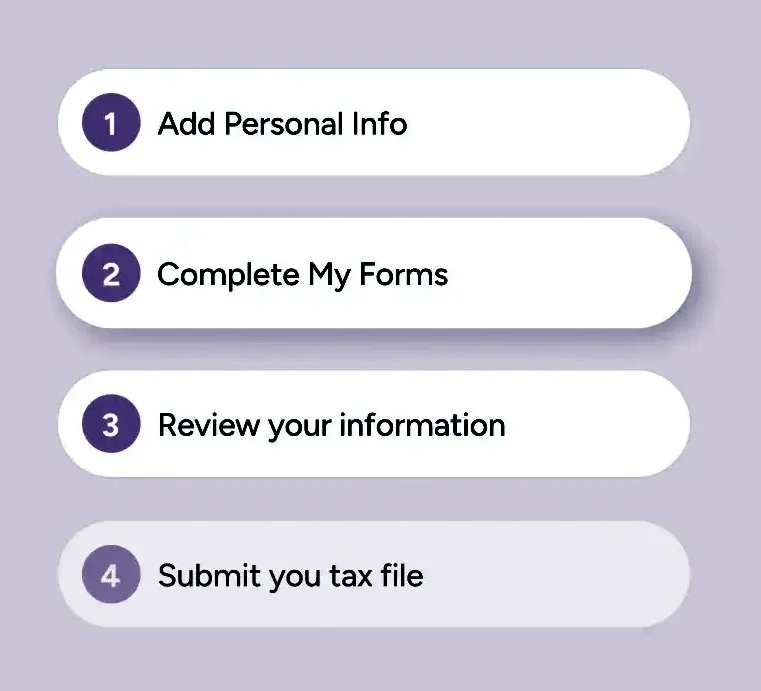

Just a few steps to get your tax done

Step 1:

Answer a few questions about yourself

Provide basic details about your tax situation, and M7 will include the correct forms in your return.

Step 2:

Import your tax slips

Quickly autofill your return by importing your tax details directly from the CRA.

Step 3:

Discover ways to save on taxes

M7 scans over 400 credits and deductions to secure your maximum refund.

Step 4:

Stay confident in your filing

Experience the M7: The best way to file your taxes

Compare plans

Key Features

M7 DIY

M7

Turbo Tax

$34.99

H&R Block

$44.99

AI powered slip scanning

Unlimited technical support via live chat

Video tutorial

Transfer last year's data

View PDF prior to filing

Digital Return Storage

Employment expenses (meals, lodging, etc.)

Donations

Medical expenses

Investment income and expenses

Rental property income and expenses

Receipt management tool

Peace of mind

for up to 7 years*

With Audit Protection, we provide unlimited CRA representation for up to seven years *for the specific tax year

-

Resolve tax debts

-

Address issues with CRA forms

-

Assist with denied credits

Questions? Answers.

Yes!

M7’s DIY + Review & File tax services use NETFILE-certified software (CloudTax) for secure and CRA-compliant filing. to ensure accuracy and maximize your return.

By choosing M7, you benefit from:

- A expert-driven platform to navigate your tax situation with confidence.

Answer a few simple questions, and you're ready to go. Don’t worry about your T-slips—we can import them directly from the CRA using Auto-fill My Return.

For more complex tax situations, additional documents or detailed financial info may be required. But no stress—we save your progress, so you can return anytime to add the details.

Simple tax returns include:

- Employment income

- Pension income

- Other employment income such as tips

- RRSP contributions

- Child care expenses

- Unemployment (EI) and social assistance

- Worker’s compensation

- Disability amount

- Worker’s benefit

- Amount for eligible/infirm dependants

- Tuition, scholarships, bursaries, grants, student loan interest

- Caregiver tax credit

- Disability transfer

- Home accessibility tax credit

- Tax on RESPs and RDSPs

- Tax installment payments

- Age amount

Income, credits, and deductions not listed above are not covered by M7 DIY, including:

- Employment expenses (meals, lodging, etc.)

- Donations

- Medical expenses

- Investment income and expenses

- Rental property income and expenses

- Self-employed income and expenses

- Absolutely! M7 is engineered to manage an array of tax returns. This includes straightforward returns like students, seniors, newcomers, and first-time filers to more complex scenarios involving forms such as T1135 and T776, T777, T2125, etc. No matter the complexity of the tax situation, M7 is equipped to assist.

M7 DIY guides you through your taxes like an interview, asking easy questions about your life (e.g., Are you married? Do you have kids?) and automatically completing the right tax forms for you.

Our tax experts keep the platform updated with the latest tax laws to ensure we ask the right questions. Your answers help the software uncover deductions, credits, and every dollar you deserve.

Yes, you can use M7 DIY Online on any PC or Mac, and even on your tablet or smartphone with a modern web browser. Plus, we offer tutorial videos to guide you step-by-step through your tax filing process.

If you have direct deposit set up with the CRA, you will receive your refund within 8-10 days of filing.

If you don’t have direct deposit set up, it will take up to 6 weeks to receive a refund cheque by mail.

Each plan includes a tailored option for self-employed individuals, with a dedicated page just for self-employed users. You'll be able to file if you choose M7 DIY.

When you're audited by the CRA, here's what happens:

- Initial Contact: The CRA will reach out by phone or mail to notify you of the audit’s details. The auditor will present their ID before starting.

- Records Examination: The CRA will review your personal and business records to ensure tax compliance and verify the accuracy of reported benefits and refunds.

- Audit Outcome: After the audit, one of three things can happen:

- No changes to your tax assessment.

- A reduction in tax owed and a refund.

- An increase in taxes owed, requiring payment.

While you’re responsible for your tax information, working with M7 maximizes your chances of a favorable outcome. We provide expert support if you need to challenge a reassessment.

Additionally, by selecting our Plus and M7 Pro plans, you gain access to Basic Tax Audit Protection—covering guidance for responding to CRA notices. Click to learn more.

Basic

DIY + Tax review

- Self-insured

- 20 minutes of a 1:1 phone consultation with a tax expert for review

- Get all your questions answered by a real tax expert

- Employment and pension income

*Prices do not include a 13% tax, which will be added at checkout.

plus

DIY + Tax review and basic audit protection

-

Basic Tax Audit Protection

Guidance for responding to CRA notices.

- 30 minutes of a 1:1 phone consultation with a tax expert for review

- Tax expert will ensure accuracy and maximum refund

- Rental and foreign income

- Crypto tax

M7 PRO (Self-employed)

DIY + Tax review and basic audit protection. Personal and self-employment income

-

Basic Audit Protection

Guidance for responding to CRA notices.

- 40 minutes of a 1:1 phone consultation with a tax expert for review

- Business and self-employment income

- Lower your tax owing

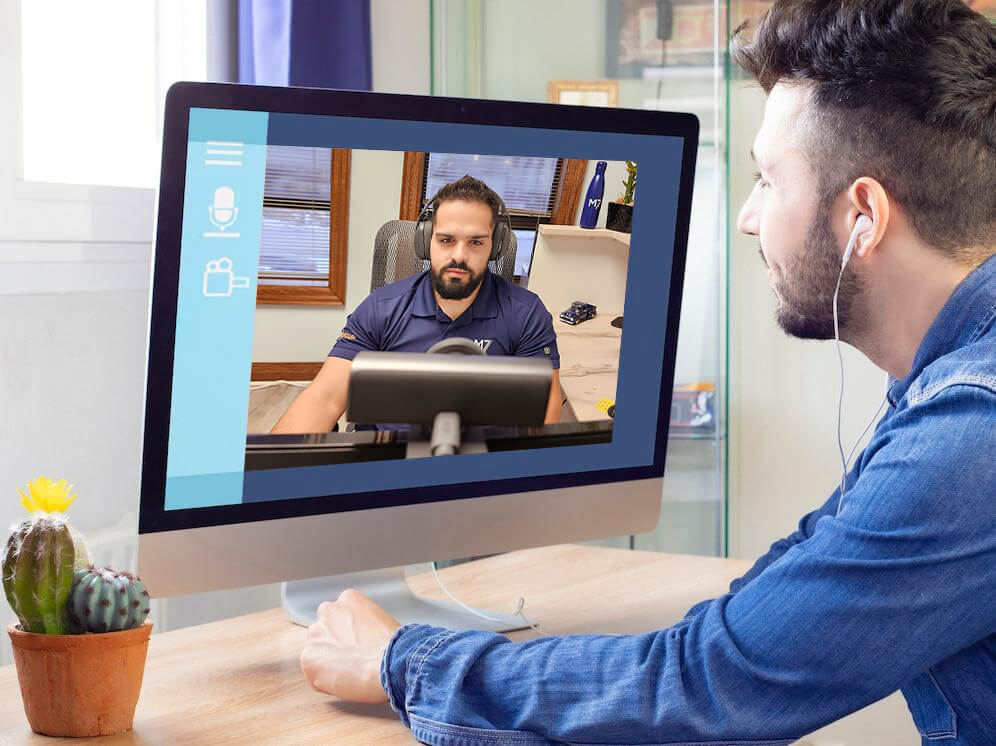

Expert tax support in English or Portuguese with M7 Tax Pro

Why M7 Tax Online?

Simple tax returns

Start your simple tax return included a review by M7 tax expert for $79.99.

Expert tax help

Get real-time assistance from a tax expert through chat or video to review your return. From March 3 to April 30, we'll be here to help weekdays from 8 AM to 8 PM, and on Saturdays from 9 AM to 3 PM.

Support for major life changes

Had a big life change affecting your taxes? We're here to ensure it's properly reported to the CRA.

Just a few steps to get your tax done

Step 1:

Answer a few questions about yourself

Provide basic details about your tax situation, and M7 will include the correct forms in your return.

Step 2:

Import your tax slips

Quickly autofill your return by importing your tax details directly from the CRA.

Step 3:

Discover ways to save on taxes

M7 scans over 400 credits and deductions to secure your maximum refund.

Step 4:

Book a final review with an expert

Peace of mind

for up to 7 years*

With Audit Protection, we provide unlimited CRA representation for up to seven years *for the specific tax year

-

Resolve tax debts

-

Address issues with CRA forms

-

Assist with denied credits

Questions? Answers.

Yes!

M7’s DIY + Review & File tax services use NETFILE-certified software (CloudTax) for secure and CRA-compliant filing. All expert support, tax reviews, and bilingual assistance (English & Portuguese) are provided exclusively by M7 to ensure accuracy and maximize your return.

By choosing M7, you benefit from:

- Bilingual support (English & Portuguese)

- Personalized tax reviews to maximize your return

- Expert guidance to navigate complex tax situations

- Hassle-free filing with trusted professionals

Simple tax returns include:

- Employment income

- Pension income

- Other employment income such as tips

- RRSP contributions

- Child care expenses

- Unemployment (EI) and social assistance

- Worker’s compensation

- Disability amount

- Worker’s benefit

- Amount for eligible/infirm dependants

- Tuition, scholarships, bursaries, grants, student loan interest

- Caregiver tax credit

- Disability transfer

- Home accessibility tax credit

- Tax on RESPs and RDSPs

- Tax installment payments

- Age amount

Income, credits, and deductions not listed above are not covered by M7 DIY, including:

- Employment expenses (meals, lodging, etc.)

- Donations

- Medical expenses

- Investment income and expenses

- Rental property income and expenses

- Self-employed income and expenses

- Absolutely! M7 is engineered to manage an array of tax returns. This includes straightforward returns like students, seniors, newcomers, and first-time filers to more complex scenarios involving forms such as T1135 and T776, T777, T2125, etc. No matter the complexity of the tax situation, M7 is equipped to assist.

We have several experts on staff, and calls are routed to those who are available. For tax season, we're extending our week hours from 8 AM to 8 PM, and we'll open on Saturdays from 9AM to 3PM. Typically, the return review takes about 20 minutes. We'll answer all your questions, ensuring you can file with confidence and the CRA receives your return properly.

Our tax experts are here to do a full review before you file whether you have questions or not. We’ll go over your return line by line to make sure nothing was missed and you’re getting back every dollar you deserve.

Each plan includes a tailored option for self-employed individuals, with a dedicated page just for self-employed users. If you choose M7 DIY & Review Self-Employed, you'll have access to an M7 expert to answer any questions and review your tax return before filing.

When you're audited by the CRA, here's what happens:

- Initial Contact: The CRA will reach out by phone or mail to notify you of the audit’s details. The auditor will present their ID before starting.

- Records Examination: The CRA will review your personal and business records to ensure tax compliance and verify the accuracy of reported benefits and refunds.

- Audit Outcome: After the audit, one of three things can happen:

- No changes to your tax assessment.

- A reduction in tax owed and a refund.

- An increase in taxes owed, requiring payment.

While you’re responsible for your tax information, working with M7 maximizes your chances of a favorable outcome. We provide expert support if you need to challenge a reassessment.

Additionally, by selecting our Plus and M7 Pro plans, you gain access to Basic Tax Audit Protection—covering guidance for responding to CRA notices. Click to learn more.

Basic

Full service

- Basic employment (T4)

- 30 minutes of a 1:1 phone consultation with a tax expert for review

- Get all your questions answered by a real tax expert

- Self-insured

*Prices do not include a 13% tax, which will be added at checkout.

plus

Full Service + Audit

- Basic employment (T4)

- 30 minutes of a 1:1 phone consultation with a tax expert for review

- Get all your questions answered by a real tax expert

-

Full Audit Protection for this tax filing

We represent you to the CRA, interpret their calls, and help resolve any issues.

M7 PRO (Self-Employed)

Full service for Truck Drivers, Uber Drivers, Taxi Drivers, Subcontractors, and Contractors

-

Full Audit Protection for this tax filing

We represent you to the CRA, interpret their calls, and help resolve any issues.

- 60 minutes of a 1:1 phone consultation with a tax expert for review

- Long-haul or Cross-border driver (TL2)

- Looking to declare Employment Expenses

- Claim for meals allowance

- A tax expert prepares and files your GST/HST return

Expert tax support in English or Portuguese with M7 Tax Pro

Why M7 Tax Online?

Taxes done for you

A tax expert handles the preparation, review, and filing of your taxes—with 100% accuracy and the best possible outcome, guaranteed*.

Expertise and background in the tax field

Our tax experts have over 12 years of professional experience in tax preparation for Canadians.

Included CRA Audit Protection

Should you face an audit, an expert will defend your return and manage all correspondence with the CRA at no additional cost.

Easy Online Service

Let an expert handle your taxes online. From March 3 to April 30, we'll be here to help weekdays from 8 AM to 8 PM, and on Saturdays from 9 AM to 3 PM.

Just a few steps to get your tax done

Step 1:

Set up your account

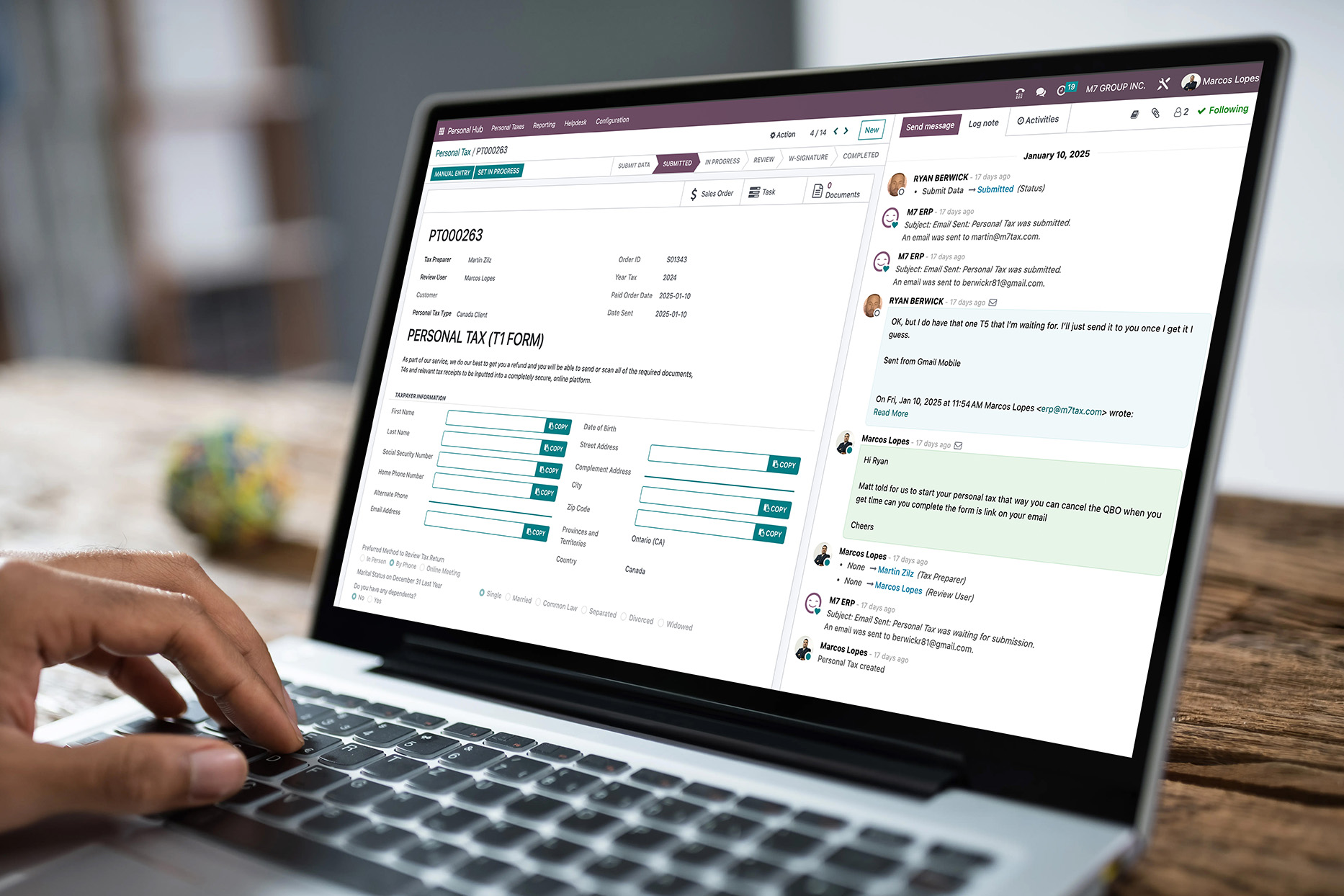

Provide some basic information about your life and work, and give us permission to retrieve your tax slips from the CRA.

Step 2:

Meet your tax expert

Quickly connect with a tax prep expert to review your uploaded documents, and they will ask key questions to help maximize your refund.

Step 3:

They manage the task

A dedicated tax expert handles your entire return, from start to finish, ensuring all credits and deductions are claimed and optimizing for the best outcome.

Step 4:

Review your return together and file

Peace of mind

for up to 7 years*

With Audit Protection, we provide unlimited CRA representation for up to seven years *for the specific tax year

-

Resolve tax debts

-

Address issues with CRA forms

-

Assist with denied credits

Questions? Answers.

- With this plan, a tax expert will file your return for you. Simply upload your documents to our platform, and we’ll handle the rest, including any corrections. You can also choose between a 30 or 60-minute expert review, where our tax expert will look for additional deductions to maximize your refund and put more money back in your pocket.

- DIY: You file your return on your own.

- DIY & Review: You file your return on your own, and a tax expert will review it with a call of up to 20 minutes.

- Full Service: You provide your information and receipts, and a dedicated tax expert files your return for you. You can choose between 30 or 60 minutes with an expert for review.

No, you don't need to meet with the M7 expert in person. Our services are fully online, so you can communicate with your tax expert through phone, email, or video call. We make the process convenient and flexible, ensuring you get expert assistance without the need for an in-person meeting.

Via chat, email, call, or video call. For tax season (From March 3 to April 30), we're extending our week hours from 8 AM to 8 PM, and we'll open on Saturdays from 9AM to 3PM. We'll answer all your questions, ensuring you can file with confidence and that the CRA receives your return properly.

When setting up your tax profile with M7 Full Service, you'll answer a few questions regarding your tax situation. This helps determine the necessary documents and forms needed for our experts to complete your return. To allow an expert to file your return, you must authorize your M7 account with the CRA. This grants us access to your tax forms directly from the CRA.

Before meeting with a tax expert, a tax preparation assistant will go over the document checklist with you and ensure all required documents are provided.

Your dedicated tax expert is here to fully fill out and review your return before we file, whether you have questions or not. We’ll go over your return line by line to ensure nothing is missed and you're getting every dollar you deserve.

Each plan includes a tailored option for self-employed individuals, with a dedicated page specifically for them. M7 Pro Self-Employed is designed for Truck Drivers, Uber Drivers, Taxi Drivers, Subcontractors, and Contractors. With this plan, you’ll get access to the following features:

- Long-haul or Cross-border driver (T4)

- Declaration of Employment Expenses

- Claim for meals allowance

- Log books (for drivers)

- Full Audit Protection for this tax filing

When you're audited by the CRA, here's what happens:

- Initial Contact: The CRA will reach out by phone or mail to notify you of the audit’s details. The auditor will present their ID before starting.

- Records Examination: The CRA will review your personal and business records to ensure tax compliance and verify the accuracy of reported benefits and refunds.

- Audit Outcome: After the audit, one of three things can happen:

- No changes to your tax assessment.

- A reduction in tax owed and a refund.

- An increase in taxes owed, requiring payment.

While you’re responsible for your tax information, working with M7 maximizes your chances of a favorable outcome. We provide expert support if you need to challenge a reassessment.

Additionally, by choosing our Plus and M7 Pro plans, you'll receive full tax Audit Protection, which includes unlimited CRA correspondence related to the specific tax year, guaranteed for seven years. We’ll represent you through the entire process. Click to learn more.

5,500+ Happy Clients - ⭐⭐⭐⭐⭐ 5 STARS ON GOOGLE!

What Mississauga Clients Say About Working With M7

If you're looking for reliable and supportive accounting, I highly recommend M7 Group. Their team was exceptional with my tax refund in Canada, providing clear explanations of tax laws. What impressed me the most was their dedication to providing excellent customer service—they were always available and went above and beyond to ensure my satisfaction. Thank you Marcos and Matthew!

Marcos and the M7 team were incredible in helping me with my taxes. It’s the first times I’ve changed accountants in over 10 years and the process was nothing less than exceptional. Fast, efficient, refund provided, great advice given. Marcos even called me to run me through what the team had done for me at the end. I felt extremely confident with them behind me and I would recommend them over and over.

Need help with Personal Tax in Mississauga?

Yes, we do. M7 is proud to offer professional and personalized personal tax filing services for individuals and families in Mississauga. Whether you're employed, self-employed, retired, or have multiple income sources, we ensure your return is filed accurately and on time. Our team of tax professionals is familiar with both federal and provincial tax credits, including those specific to Ontario residents, so we can help you make the most of every eligible deduction while staying fully compliant with CRA regulations.

To file your taxes with M7 in Mississauga, we’ll ask you to gather several key documents, including your T4 slips (for employment income), RRSP contribution receipts, T5s (for investment income), tuition receipts (T2202), donation slips, child care expenses, and any other documents related to income or deductions. If you’re self-employed, we’ll also need your income and expense summary or bookkeeping records. Don’t worry—we’ll send you a checklist to make the process simple and stress-free.

Absolutely. Maximizing your refund is one of our top priorities. At M7, we do more than just plug numbers into software. We take the time to understand your unique financial situation and apply every eligible deduction and credit, including Ontario-specific benefits like the Ontario Trillium Benefit or the Climate Action Incentive. We also look ahead to ensure future years are planned strategically, helping many Mississauga residents keep more of their hard-earned money.

No, you don’t have to visit us in person if you prefer remote service. While we welcome in-office appointments at our Mississauga location, we also offer secure virtual tax filing for your convenience. You can submit your documents electronically through our encrypted client portal, and our team will stay in touch with you throughout the process via phone or email. This flexibility makes it easy to file your taxes—wherever you are in Mississauga or the surrounding GTA.

The CRA typically opens e-filing for personal tax returns in late February. At M7, we encourage our Mississauga clients to schedule their tax appointments early, especially if they’re expecting a refund or have complex tax situations. By starting early, you avoid last-minute stress and give yourself time to gather missing information, if needed. We also offer early consultations to help you prepare your documents in advance of tax season.

Yes. If you’ve missed filing deadlines or have several years of unfiled personal tax returns, M7 can help you get caught up with the CRA. We specialize in working with individuals in Mississauga who may have fallen behind due to life changes, business transitions, or confusion about filing requirements. We’ll communicate with the CRA on your behalf, explain your options, and help reduce or avoid penalties wherever possible.

Yes, we offer year-round tax planning for Mississauga residents who want to take control of their finances beyond just filing season. Whether you're employed, self-employed, or managing investments, our team will help you structure your income, deductions, and RRSP or TFSA contributions to reduce your overall tax bill. We also help with future planning, like retirement strategies or saving for your child’s education with RESPs.

Our personal tax services are competitively priced to meet the needs of individuals and families in Mississauga. We offer flat-rate pricing based on the complexity of your return—no hidden fees or surprise charges. You’ll know the cost upfront, and we’ll walk you through what’s included. If your return is more complex (e.g., rental income, investments, self-employment), we’ll provide a custom quote with full transparency.

Yes, we do. If you're a U.S. citizen or Green Card holder living in Mississauga, you are required to file both U.S. and Canadian tax returns. M7 specializes in cross-border tax compliance and will help you meet your obligations in both countries while avoiding double taxation. Our team understands the complexities of the IRS and CRA, and we’ll guide you through FBAR filings, foreign tax credits, and treaty benefits.

Learn more at Cross-border Tax.

Yes, if you receive a review or audit letter from the CRA, we can help. Our Mississauga tax professionals will analyze the request, prepare any necessary documentation, and communicate directly with the CRA on your behalf. We’ll make sure your file is complete, accurate, and submitted professionally to minimize the risk of reassessment or penalties. We’ve helped many Mississauga residents through stressful audits with confidence and clarity.

Yes, M7 works with many self-employed individuals across Mississauga, from freelancers to consultants and tradespeople. We’ll help you track expenses, calculate income, and file your return properly—ensuring you take advantage of all eligible write-offs. Our team can also provide bookkeeping services if needed, making sure your records are clean and CRA-ready throughout the year.

Definitely. If you're new to Canada and living in Mississauga, we’ll guide you through your first tax return. We explain what counts as income, how to claim global income, and which credits or benefits you qualify for. We also help with things like determining residency status and applying for the Canada Child Benefit if you have children. Our team is patient, friendly, and here to support you every step of the way.

Yes, if you're a senior living in Mississauga and receiving eligible pension income, income splitting with your spouse can help reduce your overall tax bill. Our tax experts will assess your eligibility and calculate the benefit of splitting income on your return. We’ll also advise you on other senior-related credits like the Age Amount or Pension Income Credit to help you maximize your refund.

M7 stands out because we don’t just file your taxes—we help you understand them. With deep roots in the Mississauga community, we’ve built long-term relationships by offering clear communication, trusted advice, and year-round support. Our personalized service, transparent pricing, and focus on maximizing your financial well-being make us a top choice for individuals and families looking for more than just a basic tax return.