2026 Canadian Tax Brackets: How the New Rates Help You

What’s New for 2026

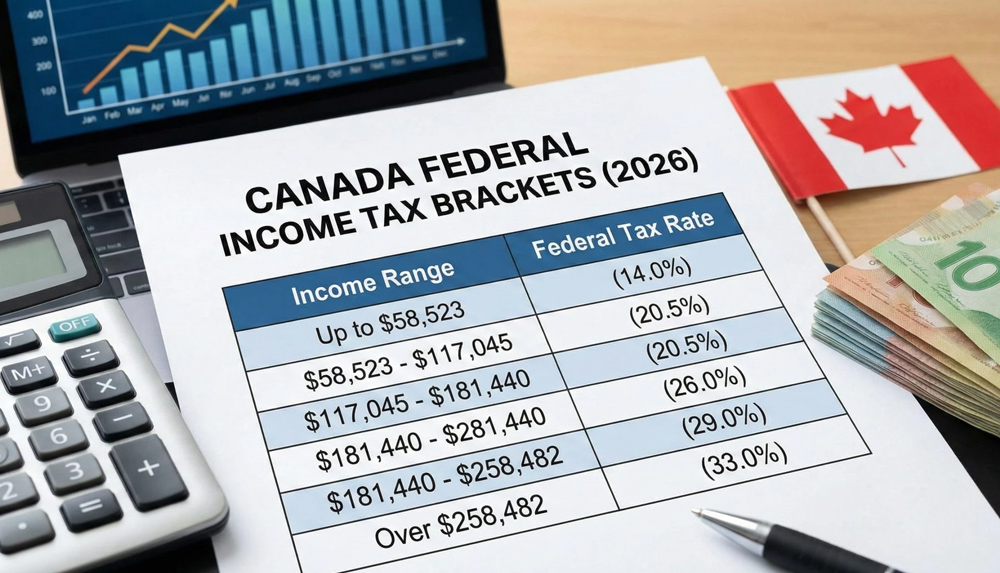

For the 2026 tax year, the federal income tax brackets have been adjusted for inflation using a 2.0% indexation factor. This prevents taxpayers from being pushed into higher brackets solely due to inflation-driven increases in income.

A key change is the reduction of the lowest federal tax rate. Historically set at 15%, it was reduced to 14% effective July 1, 2025, and for 2026 the full-year 14% rate applies. This reduction directly benefits all taxpayers, particularly middle- and lower-income earners.

With the lower starting rate, the first portion of every Canadian’s taxable income is now taxed at a reduced level, creating immediate federal tax savings across the board.

Taxable Income (CAD)

2025 Federal Marginal Rate*

2026 Federal Marginal Rate

First portion (up to $57,375)

15.0%

First $58,523 taxed at 14.0%

Next portion ($57,376 – $114,750)

20.5%

$58,524 – $117,045 taxed at 20.5%

Next portion ($114,751 – $177,882)

26.0%

$117,046 – $181,440 taxed at 26.0%

Next portion ($177,883 – $253,414)

29.0%

$181,441 – $258,482 taxed at 29.0%

Above $253,414

33.0%

Above $258,482 taxed at 33.0%

* For 2025: note that the lowest bracket rate was 15% for the full year under the official 2025 schedule.

What This Means: Potential Savings

The reduction of the lowest tax bracket to 14% means the first $58,523 of taxable income is now taxed at the lowest rate seen in decades. This change increases take-home pay for essentially all working Canadians.

Inflation-indexed brackets offer stability. As wages rise due to cost-of-living adjustments, taxpayers are less likely to drift into higher tax brackets—a phenomenon known as “bracket creep.”

For a Canadian earning approximately $140,000 per year, the new brackets result in lower tax on the income portions falling under the reduced 14% bracket. While not dramatic on their own, these savings add up when combined with tax credits, personal deductions, and planning strategies.

The increased Basic Personal Amount also provides meaningful tax relief. More income is sheltered from tax, reducing overall federal taxes owed and supporting Canadians with modest to moderate income levels.

Canada Pension Plan (CPP)

Contributions In 2026, the employee and employer CPP contribution rate will stay at 5.95%. However, the Year’s Maximum Pensionable Earnings (YMPE) — also known as the first earnings ceiling — will rise to $74,600, while the basic exemption remains unchanged at $3,500. This adjustment follows the rules set out in CPP legislation and reflects increases in the average wages and salaries paid across Canada. As a result, the maximum CPP contribution for both employees and employers in 2026 will increase to $4,230.45 each. For self-employed individuals, the CPP rate continues to be 11.9%, bringing their 2026 maximum contribution to $8,460.90.

Employment Insurance (EI)

Premiums Employment Insurance premiums are set to rise in 2026. Employees outside Quebec will pay 1.64% in EI premiums, up to a maximum annual contribution of $1,123.07 based on insurable earnings of $68,900. In Quebec, where a separate parental insurance plan exists, the employee rate will be 1.30%, with a maximum contribution of $895.70 for the year.

Tax-Free Savings Account (TFSA)

Limit The annual TFSA contribution limit will remain at $7,000 for 2026. Although the indexed TFSA amount has reached $7,185 for 2026, the limit only increases when inflation pushes the total to the next $500 increment. Since that threshold has not been reached, the limit stays at $7,000.

Registered Retirement Savings Plan (RRSP)

Limit The RRSP contribution limit for 2026 will increase to $33,810, up from $32,490 in 2025. Your personal contribution room for 2026 is based on 18% of the earned income you reported in 2025, including employment or self-employment income and rental income, up to the maximum annual limit. You may also add any unused RRSP room carried forward from 2025, subject to pension adjustments, if applicable.

Old Age Security (OAS)

For seniors receiving Old Age Security benefits, the OAS clawback (repayment) threshold for 2026 will be $95,323. If your net income exceeds this amount in 2026, your OAS payments will be reduced accordingly.

What this Means for Small Business Owners and Firms

For small-business owners, entrepreneurs, and incorporated professionals, the updated brackets create several planning opportunities.

Tax Planning for Clients

The lower starting rate and higher BPA make strategies such as RRSP contributions, salary-versus-dividend planning, and income splitting even more impactful. M7 Group can leverage these changes to help clients improve after-tax outcomes.

Compensation and Payroll Planning

Firms issuing salary adjustments or bonuses can better plan net-pay implications for 2026. Understanding the new tax brackets ensures accurate payroll forecasting, which is essential for budgeting and year-end planning.

Strategic Advisory Services

This is an ideal moment for clients to revisit how they draw income from their business. With combined effects of new brackets and ongoing economic conditions, M7 Group can guide entrepreneurs on optimizing dividends, salaries, and corporate retained earnings.

Making the Most of the 2026 Tax Brackets

The 2026 tax changes represent meaningful savings for many Canadians, especially those in the lower and middle-income ranges. By understanding how these new brackets work, you can make more informed decisions throughout the year. M7 Group is here to help you take advantage of these updates and optimize your tax strategy with personalized, forward-looking advice.