Odoo Accounting Audit

M7 audit shows you where Odoo’s accounting features are underutilized and how to configure them for maximum efficiency.

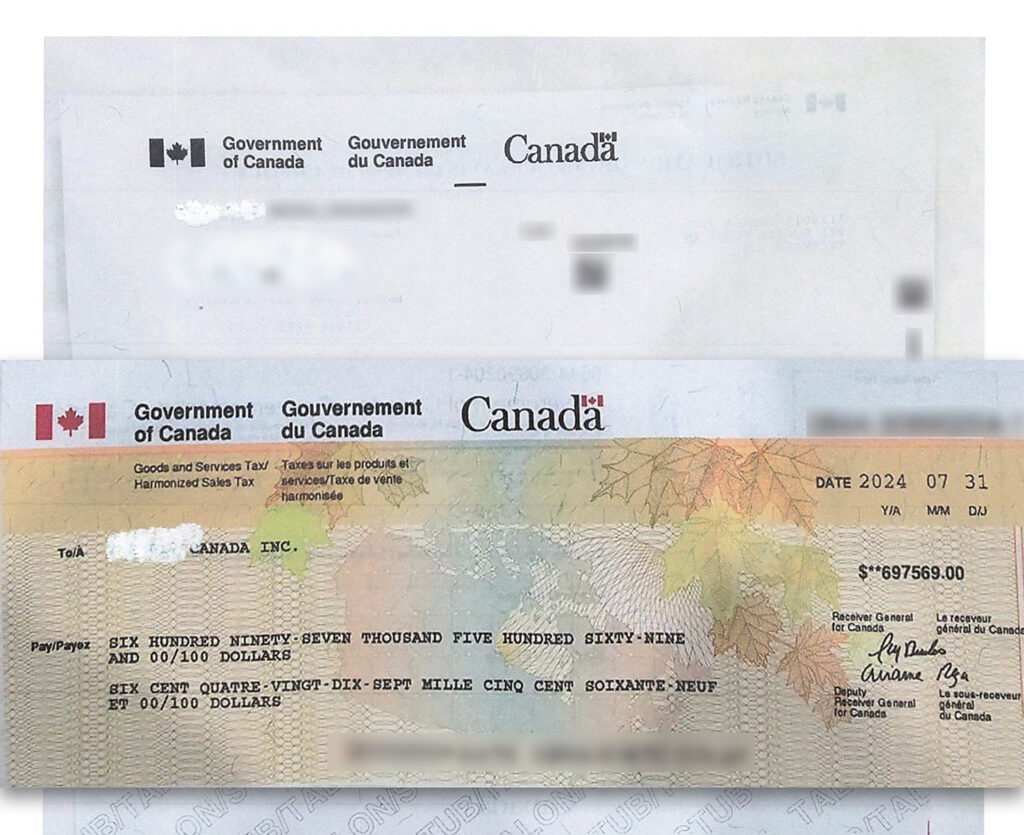

Almost $700K refund they didn’t know existed

How Etlas Freight Regained Control with M7

Challenge

Etlas Freight faced major accounting, compliance, and organizational problems that slowed growth and increased risks.

Accounting Problems:

❌ Relied on Excel spreadsheets without structured bookkeeping.

❌ No accurate tracking of expenses, accounts payable/receivable, liabilities or bank accounts.

❌ Could not measure gross income, net profit, or overall financial health.

❌ Lacked visibility on profitable routes vs. unprofitable ones.

❌ No financial reports to guide decision-making .

Organizational & Administrative Issues:

❌ Documents were scattered across boxes and folders with no standardized system.

❌ Difficult and time-consuming to locate essential files when needed.

❌ Management struggled to make timely, effective decisions due to lack of reliable data.

Tax Compliance Issues:

❌ Hadn’t filed taxes since 2017, triggering penalties, late fees, and compliance risks.

❌ Unaware of significant tax benefits and refunds available in the trucking industry.

❌ Missed opportunities to reclaim HST/GST despite large operational expenses.

Business Intelligence Gaps:

❌ No reporting on AP/AR cycles, leading to missed due dates and poor visibility on cash flow.

❌ Difficulty tracking supplier payments and customer receivables.

❌ Weak financial credibility with factoring companies and banks, resulting in limited credit.

M7 Solution

M7 Group stepped in with a structured, four-phase approach to bring clarity, compliance, and control to Etlas Freight’s operations.

Onboarding:

✔ Collected and reorganized scattered documents.

✔ Digitized bank statements and invoices, structured by vendor and year.

✔ Integrated customer’s dispatch system data into Odoo ERP.

✔ Designed and configured Odoo specifically for trucking needs.

Importation & Configuration:

✔ Imported all bills, invoices, bank transactions, and contracts into Odoo.

✔ Built a tailored Chart of Accounts with full banking and KPI setup.

✔ Configured analytical tools for expense tracking, profitability, and operational intelligence.

Bookkeeping:

✔ Published invoices and categorized bills accurately (repairs, tolls, subcontractors, etc.).

✔ Matched invoices to bank transactions and reconciled accounts.

✔ Provided true visibility into payables, receivables, and expense breakdowns.

Filing & Analysis:

✔ Conducted full financial checks for 100% accuracy.

✔ Produced critical reports: Income Statement, Balance Sheet, Aged Receivable, and Aged Payable.

✔ Delivered actionable KPIs and dashboards to support decision-making.

Results

Maximize your Odoo investment

Every hour spent working around broken processes is lost revenue. Every manual fix is a sign your system is running you. From poor adoption and inventory issues to inaccurate reports and slow sales cycles, the root cause is often a misaligned foundation. That’s what we fix—fast.