Why You’re Getting Audited… And How to Avoid It

The Canada Revenue Agency (CRA) isn’t picking names out of a hat anymore.

Audits today are driven by algorithms that scan for patterns, looking for returns that stand out in the wrong ways.

If your filing hits certain triggers, you’ll land on their radar — even if you didn’t do anything intentionally wrong. The good news? You can avoid most audits by understanding what CRA is looking for and tightening up your records.

The 3 Red Flags CRA Watches For

1. Claiming 100% Business Vehicle Use

Telling CRA your car is only for business sounds suspicious, because they know most entrepreneurs also use their vehicle for personal errands. Without a detailed mileage log, your claim won’t hold up.

Why it’s risky: No log = no proof. CRA will disallow the deduction.

2. Reporting Rental Losses Every Year

If your rental property shows losses year after year without a clear plan to turn a profit, CRA sees it as a potential tax shelter, not a legitimate business.

Why it’s risky: CRA expects a documented profit strategy. If you can’t show it, you could lose deductions.

3. Making Big Donations Without Receipts

Large charitable donations with no digital or paper trail are an audit magnet.

Why it’s risky: If you can’t produce official receipts from registered charities, CRA will deny the claim.

How To Stay Audit-Safe

Use a Mileage App

Track every business vs. personal trip with tools like MileIQ or TripLog. Automated logs beat memory and keep you credible.Write a Rental Profit Strategy Each Year

Document how you’ll generate income — planned rent increases, property upgrades, cost reductions. Keep it on file.Scan & Save Receipts Immediately

Use apps or accounting tools to create a searchable archive by date and category. Never rely on a shoebox.Match Industry Averages

CRA’s algorithms compare your expenses to industry norms. Stay within reasonable ranges for your sector.Always File On Time

Even if you can’t pay right away, file on time and arrange a payment plan. Late filing raises red flags.

Insight: Think Like the CRA

Audits aren’t punishments: they’re pattern checks. If your claims align with industry norms and you can back them up with documentation, CRA has no reason to dig deeper.

Be realistic, keep detailed records, and you’ll make your business audit-resistant.

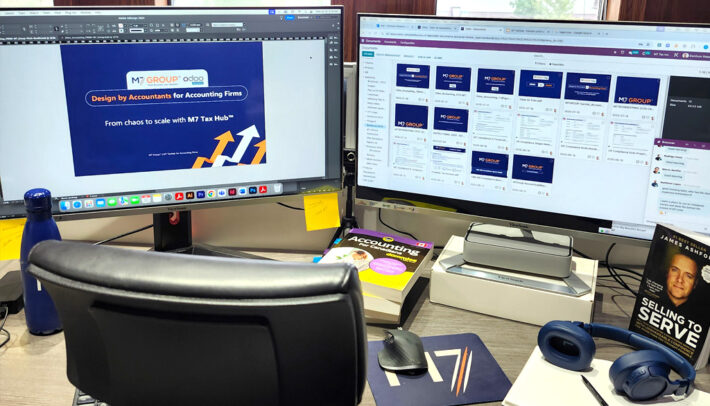

✅ Need help staying CRA-safe? At M7 Group, we help business owners protect their deductions, avoid costly mistakes, and grow with confidence.

📩 Book your free strategy session: BOOK A FREE CONSULTATION

Need help knowing which expenses keep you CRA-safe and which could trigger an audit?

M7 works closely with business owners and beyond to build confident, data-driven financial systems.

📞 Book a free consultation and start scaling smarter from day one.

📧 Have questions? Write to us at: [email protected]