Tax Season Secrets: Why You Should Hire a Tax Advisor Now

As tax season approaches in Canada, many individuals and business owners face a common question: “Should I hire a tax advisor?” The answer often depends on your financial situation and how comfortable you are navigating the complexities of Canadian tax regulations.

If you’re okay with potentially giving more money to the CRA and aren’t concerned about maximizing your savings, then hiring a tax advisor may not seem necessary. However, if you want to ensure you’re not leaving any money on the table and are fully optimizing your potential tax savings, working with a tax professional can be a valuable asset.

Why Consider Hiring a Tax Professional?

- Expertise and Experience: Tax advisors, particularly certified public accountants (CPAs) and registered tax professionals, have specialized knowledge of Canadian tax laws and regulations. They are adept at identifying deductions and credits you may not be aware of, ensuring you maximize your returns and claim every dollar you’re entitled to.

- Stress Reduction: The Canadian tax filing process can be daunting, especially if your financial situation is complex due to self-employment, significant life changes (like marriage, divorce, or the purchase of a home), or other unique financial circumstances. A tax professional can relieve you of the burden, allowing you to focus on running your business or managing your personal affairs.

- Error Prevention: Filing taxes can be complicated, and even a small mistake could result in audits, penalties, or delayed refunds. A tax advisor helps ensure your return is accurate and compliant with CRA requirements, minimizing the risk of costly errors.

“Consulting with a tax professional is essential for anyone who owns a business, manages intricate investments, or itemizes their taxes. Their expertise can help you navigate complexities and maximize your savings”

Is It Worth the Cost?

While hiring a tax preparer may seem expensive, especially for those with straightforward financial situations, the potential savings can far outweigh the cost. For individuals with more complex tax scenarios, the investment in professional help can lead to substantial savings in the long run.

In summary, if you’re looking to maximize your tax savings, minimize stress, and ensure accuracy in your tax filings, hiring a tax advisor may be the right choice for you. Don’t leave your hard-earned money to chance—consider the benefits of professional guidance this tax season.

Remember, it’s not just about filing your taxes; it’s about making informed decisions that can save you money in the future.

Ready to really take control of your tax savings? Download our free eBook now: Tax Secrets Unveiled: Maximize Your Returns and Keep More of What You Earn. In this guide, we reveal insider tips on deductions, write-offs, and strategies that most taxpayers overlook.

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

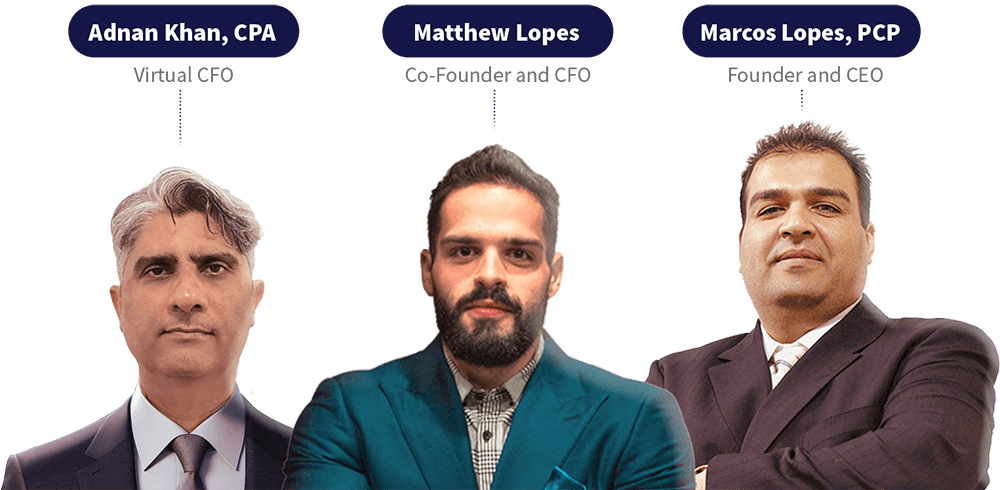

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.