Essential Tips to Master Tax Season 2025 in Canada

Get ready for tax season with our expert advice! 📝💰 Discover essential tips to maximize your returns and navigate the complexities of filing. Click to learn more!

Tax Season 2025 may seem distant, but now is the perfect time to start preparing. Early preparation can help maximize your refund, minimize stress, and ensure you don’t overlook crucial deductions.

1. Organize Your Financial Documents 🇨🇦

Having all your financial documents in order is essential for a smooth tax season in Canada. Start by gathering the following:

✅ Income Statements: Collect T4 slips from your employer, T4A slips for self-employment or pension income, and T5 slips for investment income. Ensure you have a complete record of all income received throughout the year.

✅ Expense Receipts: Keep detailed records of business-related expenses, such as travel, office supplies, and utilities. Also, gather receipts for charitable donations, medical expenses, childcare costs, and home office deductions, as these may be tax-deductible.

✅ Investment Records: If you have investment income, compile T3 and T5008 slips for stocks, bonds, and other investments to accurately report capital gains or losses.

💡 Pro Tip: Consider using a digital record-keeping system or cloud storage to keep your documents organized and secure, reducing the risk of losing important paperwork.

Let me know if you need any refinements!

2. Know Your Deductions and Credits 🇨🇦

Understanding which tax deductions and credits you qualify for can help reduce your tax bill:

✅ Tax Credits: Take advantage of Canada’s key tax credits, such as the Canada Child Benefit (CCB), Climate Action Incentive (CAI), and Disability Tax Credit (DTC).

✅ Deductions: Consider deductions for tuition fees, student loan interest, home office expenses, medical expenses, RRSP contributions, and charitable donations.

3. Stay Informed on Tax Law Changes

Tax rules change yearly, so it’s essential to stay updated for 2025. Keep an eye on:

📌 New tax brackets and rates

📌 Updates to tax credits and deductions

📌 Any changes affecting self-employed individuals or businesses

4. Make Estimated Tax Payments

If you’re self-employed or earn income without tax deductions at source, set aside money for quarterly tax payments to avoid penalties. This applies to freelancers, business owners, and rental income earners.

5. Keep Deadlines in Mind

📆 The standard tax filing deadline in Canada is April 30, 2025.

📆 If you or your spouse/common-law partner are self-employed, you have until June 15, 2025 (but any taxes owed must still be paid by April 30).

6. Consult a Tax Professional

Navigating Canada’s tax system can be complex, but working with a tax expert ensures you maximize every deduction and credit available to you.

💰 Ready to conquer Tax Season 2025?

📞 Reach out to M7 Tax today for expert guidance and personalized tax strategies designed for your unique situation. Don’t let tax season stress you out—we’re here to help! 🚀

Let me know if you’d like any refinements!

Download our eBook, give us a call, and let’s make this tax season the most profitable one yet! And if you need help, don’t hesitate to seek PROFESSIONAL ASSISTANCE to keep your business on the right track.

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

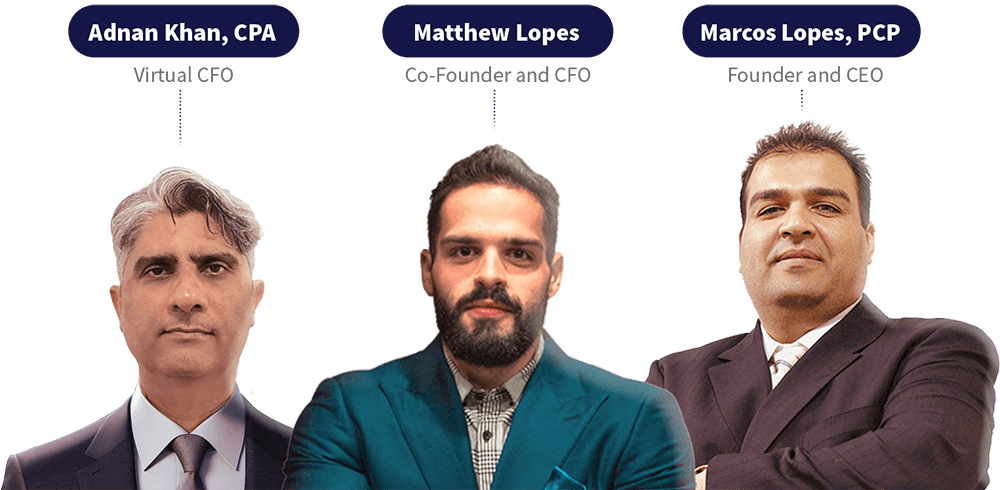

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.