Maximize Your Refund: Get Those Ducks in a Row Fast for Tax Season 2025!

Tax season is a time that many dread—not just because of the payments owed, but also the mountain of paperwork that comes with preparing for it. For employees, the tax-filing process is often quite simple. However, for entrepreneurs and small business owners, things can get a little more complicated. If you identify as a business owner, this article is tailored just for you!

Are You a Financial Whiz or a Disorganized Dreamer?

Financial Whiz: Your expense reports or accounting software are updated consistently each month.

Disorganized Dreamer: Your receipts are stuffed into a box (if they’ve been saved at all!), turning tax season into a mad dash.

Which category do you fall into?

If you find yourself in the “financial whiz” group, congratulations! You’re likely running a well-organized, thriving business.

But if you’re more of a disorganized dreamer—an innovative entrepreneur who prefers closing deals and networking over crunching numbers—you’re in good company.

Don’t fret; being disorganized doesn’t equate to failure. This year, we encourage you to tackle your receipts, bookkeeping, and tax responsibilities in a new way.

Steps to Regain Control Over Your Business Finances

-

Gain a Clear Understanding of Your Finances

As a business leader, having a solid grasp of your financial situation is crucial. Take charge and stay informed about your business’s financial health. -

Seek Professional Assistance

Think about hiring a financial expert who enjoys dealing with numbers. Whether you need someone to establish your accounting systems or provide ongoing support, outsourcing can give you the freedom to concentrate on your strengths. -

Regularly Review Financial Statements

Schedule time each month to go over your financial statements. This practice keeps you informed about your business’s cash flow and empowers you to make well-informed decisions. -

Shift Your Mindset About Money

Consider your beliefs surrounding money. Are they propelling you forward, or are they holding you back? A shift in your perspective can significantly impact how you manage your finances. -

Craft a Comprehensive Plan

Create a Financial Plan, a Business Plan, and even a Life Plan. These documents will help steer your long-term decisions and prepare you for what lies ahead. -

Make Financial Management Enjoyable

Transform your financial reviews into a positive experience! For instance, when settling expenses, round up to the nearest dollar and express gratitude for what those expenditures have enabled you to achieve in your business.

Successful Entrepreneurs Recognize When to Seek Help

The most successful business owners understand their strengths and weaknesses. If managing finances isn’t your forte, consider hiring external help or implementing robust systems, allowing you to focus on what you love about your business.

Keep in mind that money only holds the significance you assign to it. By altering your narrative about money, you can transform not just your business but your entire life.

Download our eBook, give us a call, and let’s make this tax season the most profitable one yet! And if you need help, don’t hesitate to seek PROFESSIONAL ASSISTANCE to keep your business on the right track.

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

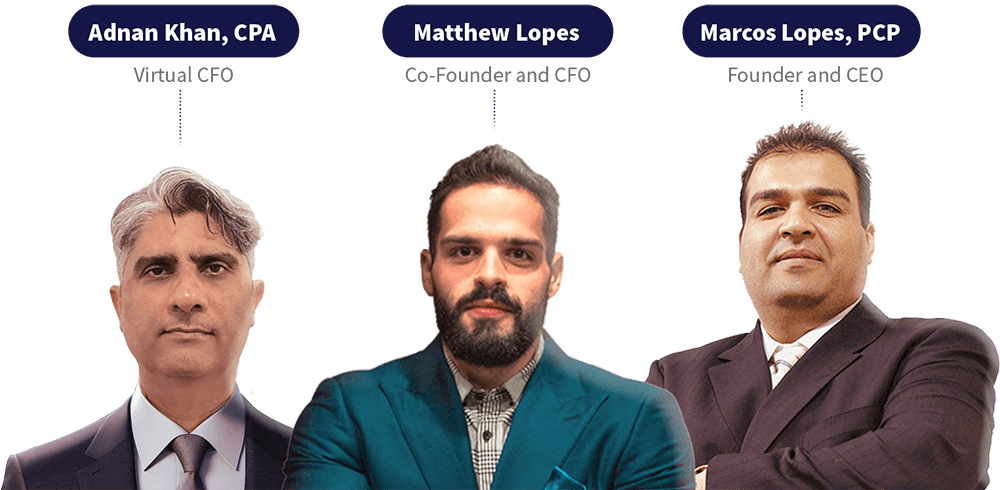

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.