Top Reasons to Outsource Your Bookkeeping to a Professional Accounting Firm

Outsourcing your accounting and bookkeeping services offers numerous benefits to small businesses, start-ups, and entrepreneurs. At M7 Tax, we understand the challenges of hiring an in-house accountant or bookkeeper with the necessary skills to manage financial operations like preparing invoices, handling bank accounts, and analyzing financial data. Here are some of the key advantages of choosing to outsource these essential tasks:

“Consulting with a tax professional is essential for anyone who owns a business, manages intricate investments, or itemizes their taxes. Their expertise can help you navigate complexities and maximize your savings”

1. Cost Savings

Outsourcing accounting services can be a cost-effective solution. Rather than hiring a full-time employee, which includes salary, benefits, and other overheads, outsourcing allows you to pay only for the services you need. You can focus on more productive activities while reducing costs with efficient resources and technology provided by the accounting firm.

2. Eliminate Time and Costs of Hiring

The recruitment process for qualified accountants can be time-consuming and costly. By outsourcing, you can avoid the hassle of finding the right candidate and reduce the time and resources spent on hiring and training. An outsourced firm provides you with experts right from the start, saving you time and money.

3. Save Your Time

As your business grows, managing your finances can become more time-consuming. Outsourcing your accounting and bookkeeping allows you to focus on scaling your business rather than handling day-to-day financial tasks. This frees up your time to develop strategies, build relationships with clients, and grow your company.

4. Access to Expert Accountants

When you outsource, you gain access to a team of specialized accountants and bookkeepers who are up-to-date with the latest trends, tools, and accounting practices. These professionals are continuously improving their skills to remain competitive in the market, ensuring that your business benefits from the best possible financial advice and services.

5. Scalability

Outsourcing accounting services allows your business to scale effortlessly. Whether your bookkeeping needs increase or decrease, your service provider can adjust the level of resources without the need for additional recruitment or training. Many firms charge based on hours worked, providing flexibility to manage costs as your business grows.

6. Automation and Technology

Accounting automation software is widely used by outsourced firms to streamline financial processes. These tools reduce human errors, provide real-time reports, and help identify and resolve issues early. By leveraging technology such as QuickBooks, Xero, or Sage, your business can save time and reduce the risk of fraud or inaccuracies.

7. Expert Financial Advice

Outsourcing to a knowledgeable accounting firm gives you access to advice and insights from professionals experienced in various industries. They can help you optimize your accounting processes, stay compliant with tax regulations, and provide strategic guidance for business growth.

Conclusion

Outsourcing your accounting and bookkeeping services to M7 Tax can provide numerous benefits, from cost savings and expert guidance to increased scalability and the use of cutting-edge technology. By partnering with professionals, you can focus on growing your business while ensuring your finances are in capable hands. Let M7 Tax help you streamline your operations and stay compliant, so you can achieve sustainable growth.

Ready to really take control of your tax savings? Download our free eBook now: Tax Secrets Unveiled: Maximize Your Returns and Keep More of What You Earn. In this guide, we reveal insider tips on deductions, write-offs, and strategies that most taxpayers overlook.

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

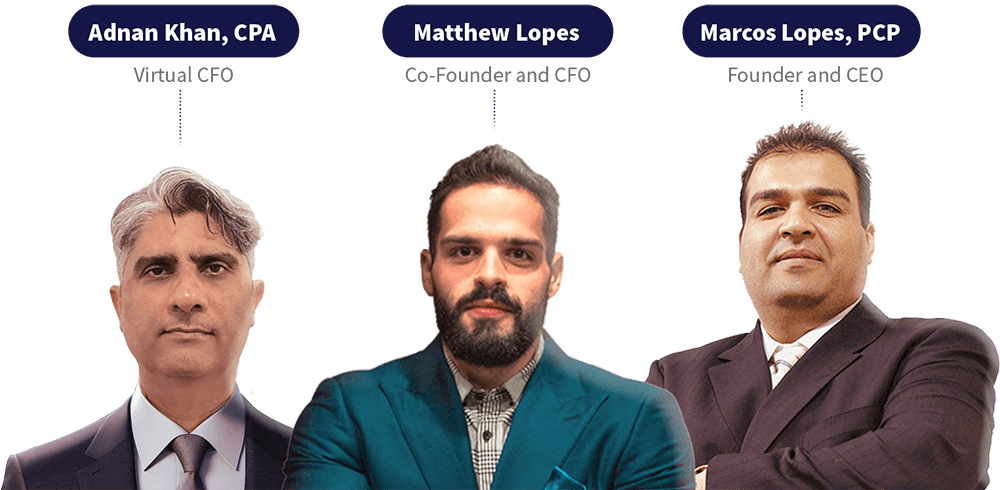

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.