$80k in Tax-Free Savings with FHSA

Hello, First-Time Home Buyers! 👋🏼

If you’re dreaming of owning your first home, you’ve likely come across various savings plans designed to help you get there. Among these, the First Home Savings Account (FHSA) stands out as a powerful tool. If you and your partner are planning to purchase a qualifying home within the next few years, you could potentially save up to $80,000 combined by each opening an FHSA and maximizing your contributions. Let’s explore how this works and what it could mean for your future as homeowners.

What Is an FHSA?

The FHSA is a registered plan specifically designed to help first-time home buyers save for their first home—completely tax-free. It allows you to contribute up to $8,000 per year, with a lifetime contribution limit of $40,000. The best part? Your contributions are tax-deductible, and when it’s time to withdraw your funds to purchase your first home, those withdrawals are tax-free.

In contrast, Canada’s existing Home Buyers’ Plan (HBP) allows eligible Canadians to withdraw up to $35,000 from their RRSP to purchase their first home. However, the HBP requires you to repay the withdrawn funds within 15 years. The FHSA doesn’t have this repayment requirement, making it a more flexible and potentially less stressful option for many first-time buyers.

The Power of Dual Contributions

Now, imagine this: you and your partner each open an FHSA and maximize your contributions. Over time, this means you could save up to $40,000 each, for a total of $80,000 combined. This amount could grow even more depending on your investment strategy within the FHSA—whether you choose to invest in stocks, bonds, mutual funds, or other options available to you.

This combined savings can serve as a substantial down payment on your first home, reducing the amount you need to borrow and, consequently, the interest you’ll pay over the life of your mortgage. The earlier you start contributing to your FHSA, the more time your investments have to grow, potentially boosting your home-buying power even further.

Who Can Open an FHSA?

To qualify for an FHSA, you must meet the following criteria:

👉🏼 Be 18 or older

👉🏼 Be a Canadian resident

👉🏼 Be a first-time home buyer (i.e., you haven’t owned a home in the current or previous four calendar years)

What If Plans Change?

Life doesn’t always go according to plan, and you might find yourself in a situation where you decide not to buy a home or no longer qualify as a first-time home buyer. If this happens, don’t worry—you have options. You can transfer your unused FHSA savings to another FHSA or an RRSP without any tax consequences. Alternatively, you can withdraw the funds, though these withdrawals will be subject to taxes.

Final Thoughts

The FHSA offers a unique and valuable opportunity for first-time home buyers to save for their dream home with tax benefits that can make a significant difference in your financial journey. By starting early and maximizing your contributions, you and your partner can build a solid financial foundation, giving you more freedom and flexibility when it comes time to make one of the most important purchases of your lives. So why wait? Open your FHSA today and take a step closer to homeownership!

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

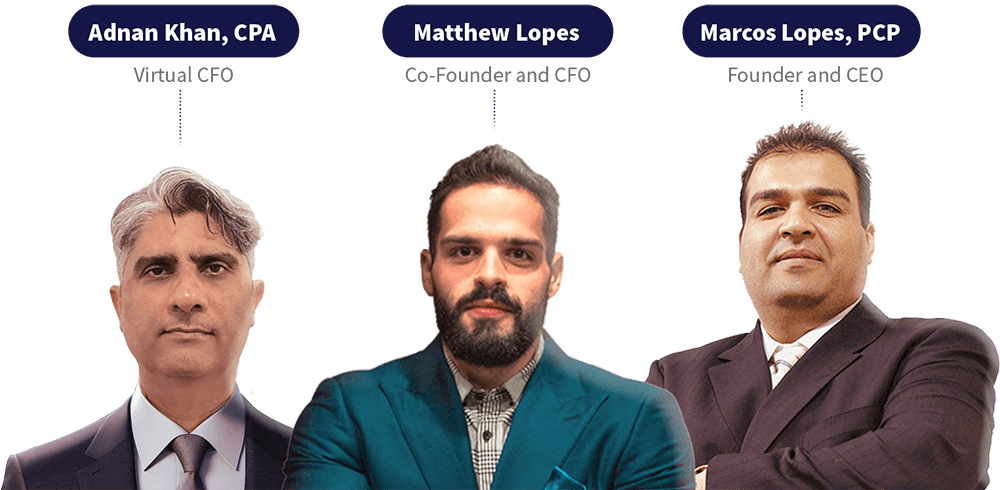

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.