Why strong bookkeeping matters for Canadian construction industry?

Navigating Canada’s construction scene demands sharp financial acumen. With costs, cash flow, and regulations to juggle, robust bookkeeping isn’t just helpful—it’s vital. Join us as we delve into why solid bookkeeping services is a cornerstone for Canadian construction firms.

1) Effective Methods for Accurate Financial Records

Accurate financial records are paramount for construction companies, and strong bookkeeping services are indispensable for achieving this. Given the multitude of daily transactions, spanning materials purchases, subcontractor payments, and project expenses, meticulous record-keeping is imperative. A professional bookkeeper meticulously records, categorizes, and reconciles all financial transactions, offering a precise and current overview of your company’s financial standing.

2) The Essentials of Cash Flow Management

Efficient cash flow management is pivotal for construction firms, facilitating the funding of ongoing projects, timely payments to suppliers and subcontractors, and covering operational expenses. Robust bookkeeping services play a vital role in this process by meticulously tracking cash inflows and outflows, monitoring accounts receivable and payable, and accurately forecasting cash flow requirements. By proactively managing cash flow, construction companies can sidestep cash shortages, reduce borrowing expenses, and uphold financial stability, even amidst varying demand cycles.

3) Mastering Compliance with Tax Regulations

Navigating Canada’s intricate tax regulations poses a challenge for construction companies, especially given the ever-changing tax landscape. Corporate tax accountants specializing in the construction industry offer tailored tax planning, compliance, and reporting services. They ensure businesses remain compliant with federal and provincial tax laws, maximize deductions and credits, and minimize tax liabilities. Partnering with these experts helps construction firms avoid costly mistakes, mitigate tax risks, and optimize their tax position.

4) Precision in Job Costing and Profitability Analysis

Strong bookkeeping services serve as the bedrock for sustainable growth and expansion within construction companies. Through precise financial records, streamlined cash flow management, and adherence to tax regulations, a robust financial infrastructure is established, fostering an environment conducive to business growth endeavors. With the guidance of a corporate tax accountant, irrespective of location, construction firms are equipped to navigate financial hurdles, capitalize on opportunities, and carve out a path towards enduring success within Canada’s competitive construction landscape.

5) The Power of Financial Reporting and Analysis

Effective job costing is indispensable for construction companies, enabling precise allocation of costs to individual projects, ongoing profitability monitoring, and informed decision-making. Robust bookkeeping services encompass meticulous tracking of project expenses, labor costs, and overheads, facilitating real-time calculation of project margins and profitability assessment. Armed with insights into each project’s financial performance, construction firms can pinpoint inefficiencies, fine-tune pricing strategies, and optimize resource allocation to enhance profitability.

6) Strategies for Business Growth and Expansion

Timely and precise financial reporting stands as a cornerstone for construction enterprises, facilitating performance evaluation, trend identification, and informed decision-making. Robust bookkeeping services deliver comprehensive financial statements encompassing income, balance, and cash flow, empowering companies to closely monitor financial performance and track pivotal metrics. Furthermore, financial scrutiny conducted by a corporate tax accountant specializing in construction augments this process, pinpointing areas ripe for enhancement, cost-saving initiatives, and strategic growth pathways.

7) Essential Bookkeeping: Driving Success in Canadian Construction

In summary, robust bookkeeping services are indispensable for Canadian construction companies, fostering stronger businesses, sustained financial well-being, and accelerated growth. Through collaboration with a corporate tax accountant, regardless of location, these firms can ensure the precision of financial records, streamline cash flow management, adhere to tax regulations, and make informed decisions. With this solid financial footing, construction companies are poised to flourish within Canada’s dynamic construction sector, effectively realizing their business goals.

Read more about Corporate Tax.

For more information on how M7 Group can assist you, and other tax-related matters, contact us today.

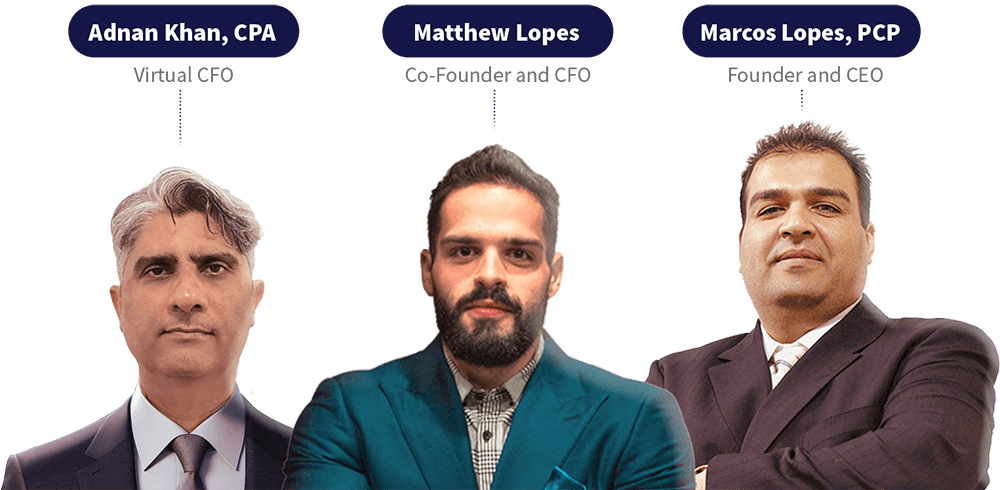

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.