Filing taxes for an incorporated business? Here’s what to watch for

Keep these four things top of mind when preparing your T2 return effectively!

Once you incorporate your business, there are also a different set of tax rules to follow when filing your year-end taxes.

As tax season approaches, the biggest difference between an incorporated business and an unincorporated business is how you will file your business’ tax return. For starters, incorporated businesses must set their filing date, which is six months after the business’ year-end. So, if your fiscal calendar closes on Dec.31, you have until June 30 the following year to file. Here are four other things to look out for when filing for your

1) KNOWING WHAT TO FILE

Many businesses will bill for work that is in the midst of being completed but may not yet be finished by the time the filing deadline rolls around. Or perhaps the work has been completed but the payment has yet to be received. In both cases, the payment in question must still be filed on the business’ T2.

2) MISSED DEDUCTIONS

One of the more frequent missed deductions are in the form of the amounts that have been expended and not been properly accounted for.

It can happen in situations such as if you record an asset that perhaps was a one-time purchase with a minimal shelf life—as opposed to the required lasting life of more than one year to qualify as a business expense, such as a new laptop.

The capital items are not immediate deductions, as you need to amortize the amount over time. That is complicated by the Income Tax Act’s many rules regarding the timing and required amounts for writing off capital expenditures, which makes errors common.

3) PHANTOM DEDUCTIONS

Phantom deductions do not exist. If there are instances of missed reporting, it’s because something was not properly declared, such as whether an automobile is truly a business expense versus a personal expense. This is where people with incorporated businesses may mistake what can be deducted, especially if lines are blurred between filing their T1 and T2.

We always tell entrepreneurs, start with everything that you’ve spent money on and think about whether or not that’s a business expense or personal expense. And then you won’t miss anything.

4) CONSIDER AN ACCOUNTANT

While tax-filing software is handy, nothing beats the expertise of a tax accountant. Avoid common mistakes and ensure compliance with our help.

The most common (FILING WITHOUT AN ACCOUNTANT) mistake is missed reporting of revenue because a lot of people don’t understand how they have to record revenue. Anyone defined as a professional must include income work in progress – and this is often a point that gets missed.

Another complication when using a corporation is determining how the owner-manager will receive funds from the corporation to pay for their personal expenses. Often, these funds will be paid as a salary or dividend, or perhaps even both. We at M7 Group can help you determine the most efficient remuneration strategy based on your personal circumstances and to ensure all the compliance steps are completed. A salary or dividend has to be reported on a T-slip and source deductions are required on a salary.

At M7 Group, we offer the expertise and support necessary to ensure your T2 return is prepared effectively, maximizing deductions while maintaining compliance with the regulations.

With our assistance, you can to know that your financial affairs are in capable hands!

For more information on how M7 Group can assist you, and other tax-related matters, contact us today.

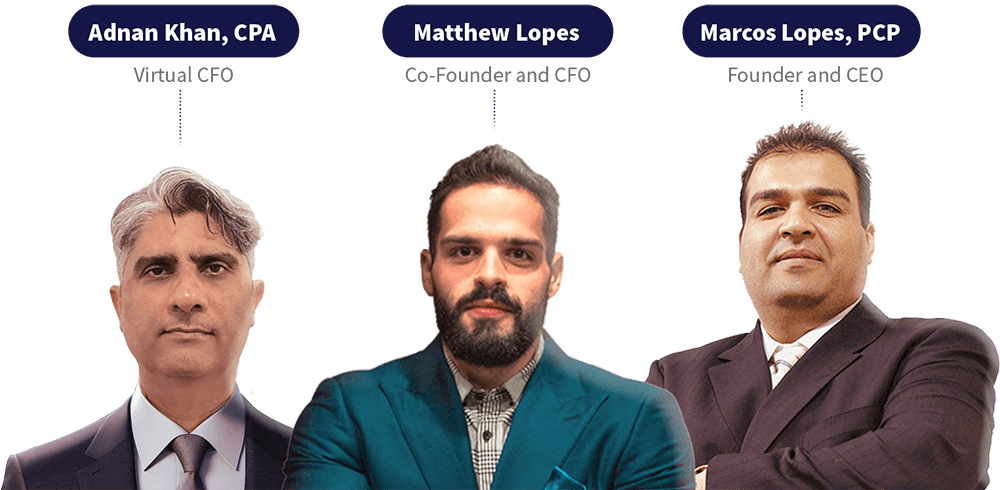

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.