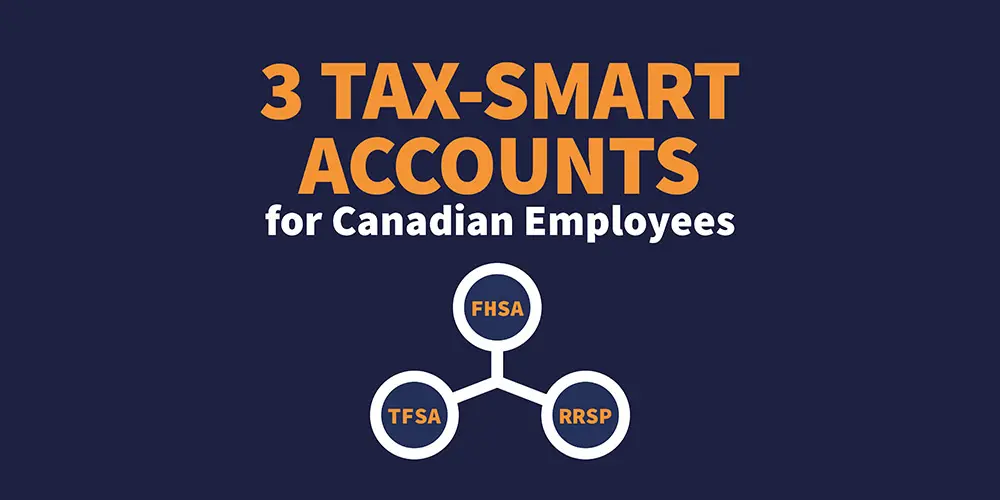

3 Tax-Smart Accounts Every Canadian Employee Should Use

If You’re a Canadian Employee, Here Are 3 Tax-Smart Accounts to Use Before Year-End! Download eBook.

As the year winds down, it’s the perfect time to review your financial strategies and take steps to minimize your tax liability. Leveraging the right accounts can help you save on taxes while working toward your financial goals. Here are three powerful tools you should consider before the year-end:

1. FHSA: First Home Savings Account

The FHSA is a game-changer for first-time homebuyers. It allows you to save for your dream home while benefiting from tax advantages. Contributions are tax-deductible, and withdrawals for qualifying home purchases are tax-free. If buying a home is in your future, this account can give you a head start while reducing your taxable income.

Key Benefit: Tax-deductible contributions and tax-free growth.

2. TFSA: Tax-Free Savings Account

A TFSA is perfect for anyone looking to grow their investments without worrying about taxes. Whether you’re saving for short-term goals or building long-term wealth, the income and growth in a TFSA are completely tax-free. Plus, you won’t face penalties when you withdraw your funds.

Key Benefit: Tax-free growth and withdrawals, making it a flexible savings tool.

3. RRSP: Registered Retirement Savings Plan

The RRSP is a staple for Canadians looking to secure their financial future while enjoying immediate tax benefits. Contributions reduce your taxable income for the current year, and the funds grow tax-deferred until retirement. Planning for your future has never been more rewarding.

Key Benefit: Immediate tax deductions and tax-deferred growth.

Why Act Now?

Contributions to these accounts often have annual limits or deadlines tied to the tax year. Taking advantage of them before December 31st ensures you maximize your savings for the current tax year and start the next one on a strong financial footing.

Need Guidance?

Understanding how to use these accounts effectively can be complex, but you don’t have to navigate it alone. At M7 Group, we specialize in financial strategies that help you save money and grow your wealth.

Contact us today to discuss your options and start minimizing your taxes before the year ends! Book a FREE 15-Minute Consultation! 👉 DOWNLOAD EBOOK TODAY: Click Here Now!

Remember, money only holds the meaning you give it. Change your story around money, and it can transform not only your business but your entire life.

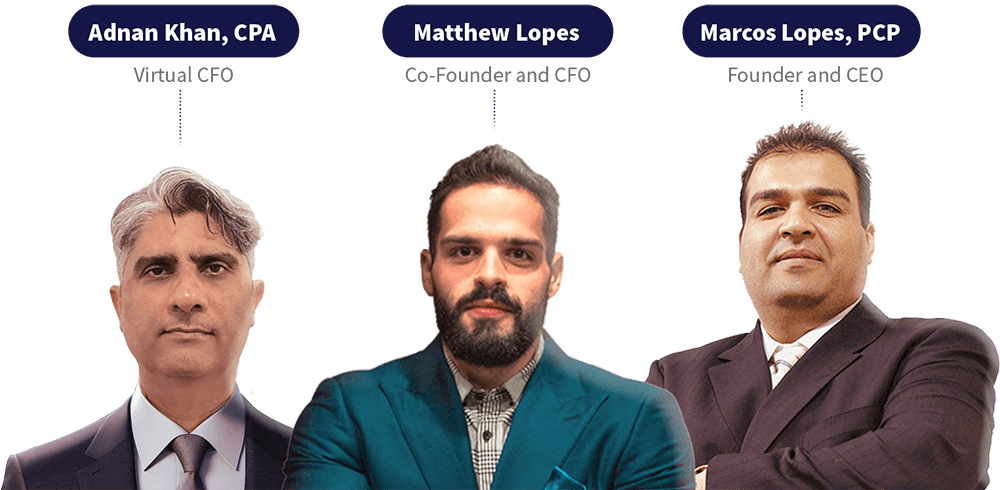

Meet the experts behind M7 Group: Adnan Khan, CPA; Matthew Lopes; and Marcos Lopes, PCP. Together, they provide comprehensive tax, accounting, and financial advisory services across North America.

For more information on how M7 Group can assist you and your business with TAX Services, financial clarity, and strategic growth planning, contact us today.